The number of Belgian households reporting foreign bank accounts to the tax office last year increased to 378,652, up from 350,258 in 2022, according to data from the federal finance department.

The number of Belgians registered for insurance overseas also increased - by 0.5% - to 64,165 individuals.

Last year, 2,923 tax returns reported a foreign legal structure, which was almost 200 more than the previous year. These returns are subject to the so-called 'Cayman Tax,' which targets income from certain financial transactions that are routed through tax havens.

Fiscal year 2023 revealed that 2,615 Belgians had exceeded the tax exemption threshold on savings accounts, declaring interest on approximately €3.064 million. In 2022, 2,613 savers declared interest on around €2.33 million.

Interest from savings accounts up to €980 per person is exempt from the 15% withholding tax. In 2024, this limit will increase to €1,020. Banks automatically deduct the withholding tax for interest exceeding this limit, although persons with accounts in multiple banks must declare this themselves if they surpass the threshold.

In 2023, 586,187 Belgians reclaimed the withholding tax on dividends, amounting to €75.51 million, an increase on the 551,304 persons who reclaimed €68 million in the 2022 tax year.

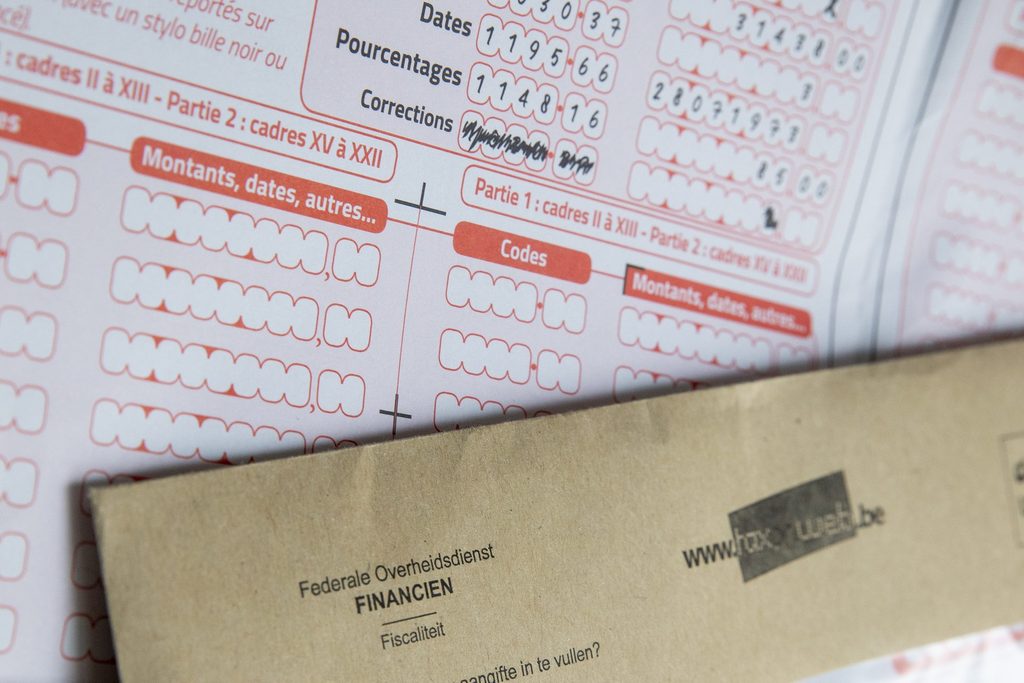

The figures for the 2023 tax year reflect the situation as of 30 June that year. The 2024 tax return, reflecting last year’s income, must be submitted online by 15 July at the latest. For paper declarations, the deadline was at the end of June.