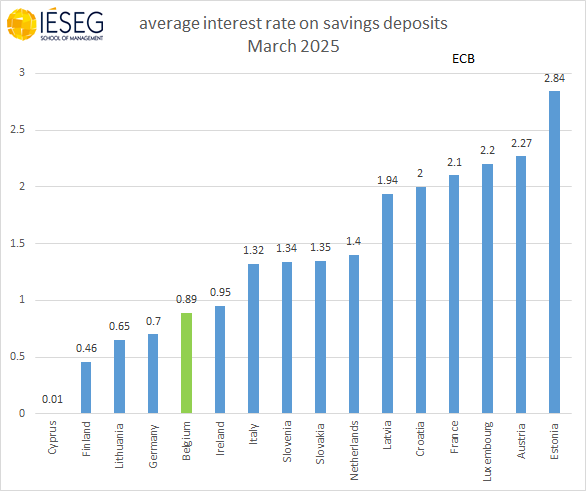

Savings accounts with Belgian banks have a much lower interest rate than in most other Eurozone countries, according to new data from the European Central Bank (ECB).

In Belgium, the average interest rate paid by banks on savings deposits stood at 0.89% in March – much lower than in most neighbouring countries: the average rate was 1.4% in the Netherlands, 2.1% in France and even 2.2% in the Grand Duchy of Luxembourg.

"Savers in Belgium, in the form of regulated savings, are particularly penalised because inflation in the country is higher than the rise in prices in many countries where interest rates on regulated savings deposits are higher," Eric Dor, the Director of Economic Studies at the IESEG School of Management, told The Brussels Times.

"Inflation, based on the harmonised consumer price index, is 3.1% in Belgium compared with 0.8% in France. The difference in real interest rates is therefore enormous," he added.

Credit: IESEG

For a long time, the average rate on savings deposits in Belgium had remained at 0.09% until December 2022. Then, the rate rose slightly to a maximum of 1.03% in December 2023, following the energy and inflation crisis, and the resulting rise in the key ECB interest rates.

"However, this rise in the average rate on savings deposits in Belgium was much lower than the increases recorded almost everywhere else," Dor said. "The maximum rates were 3.5% in the Grand Duchy of Luxembourg, 2.7% in France and 1.5% in the Netherlands, for example."

Interestingly, the rates paid by banks in Belgium on term accounts (where funds are locked in for a specific period with a pre-determined interest rate) are much better than on savings accounts, at 2.09%. While still lower than the average rate in the Netherlands (2.4%) and France (2.34%), it is slightly higher than that in Luxembourg (2.06%).

Credit: Belga/Jonas Hamers

"This reflects the strategy of banks in Belgium, which prefer to compete on the limited segment of term deposits to attract dynamic savers, rather than on the mass of regulated savings deposits. This is less costly for Belgium's banks," Dor said.

That is because this way, they can take advantage of the inertia of passive savers, many of whom fail to take advantage of the better rates offered by certain small banks – even in the regulated savings segment.

Term accounts vs saving accounts

In March 2025, savings deposits totalled €284,548 billion in Belgium. Of this total, nearly all (€280,284 billion) was held by households. Term deposit accounts held by households amounted to just €56.861 billion.

"This means that regulated household savings earn relatively less in Belgium than elsewhere in the Eurozone," Dor said.

On the other hand, however, he pointed out that the average rate that is charged by banks in Belgium on new residential property loans is lower than in most other eurozone countries.

"In March, the average rate on new residential property loans was just 3.07% in Belgium, compared with 3.7% in Ireland, and 3.5% in the Netherlands and Luxembourg, for example. At 3.05%, the rate is still very slightly lower in France."