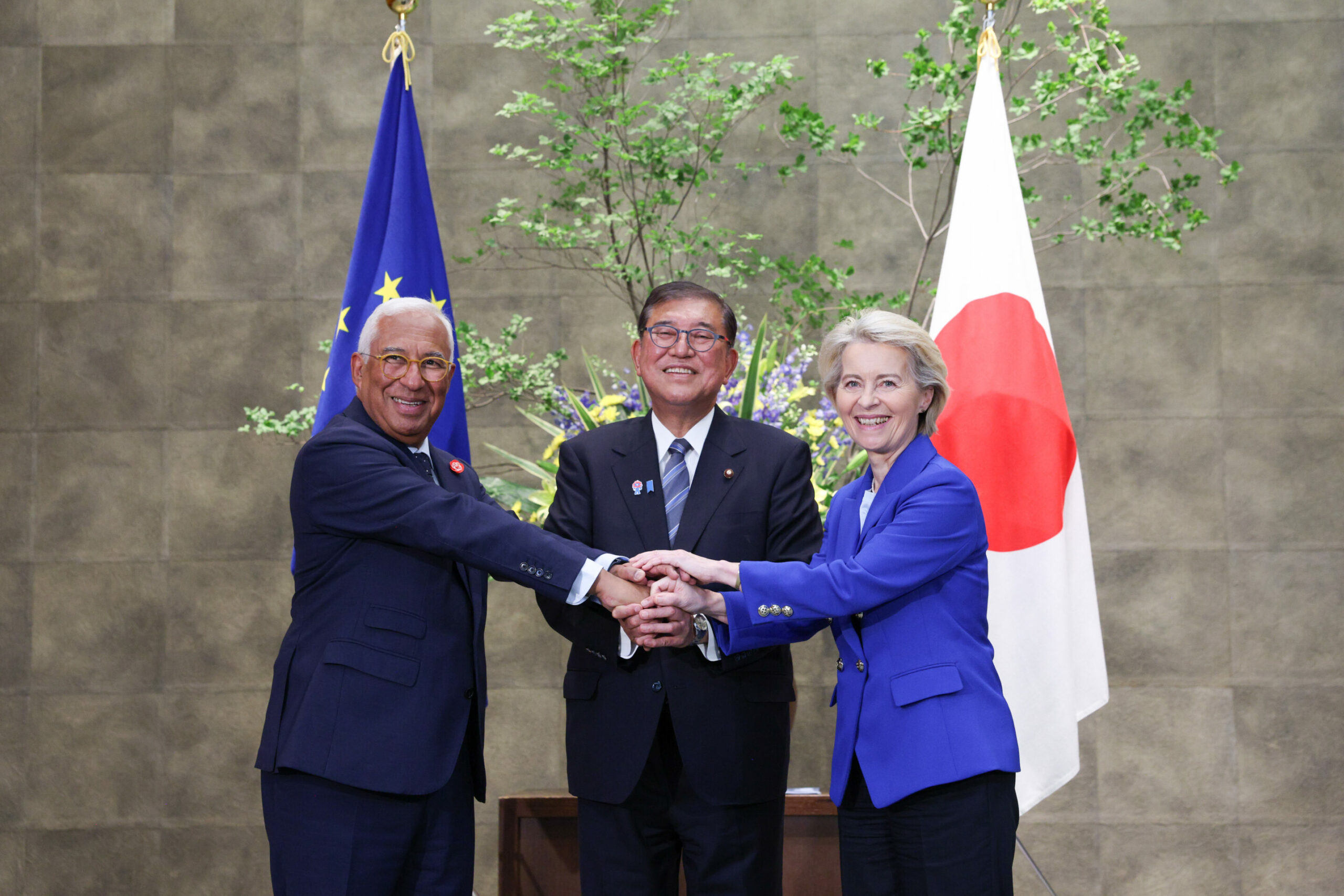

Yesterday, the European Commission President Ursula von der Leyen and Council President António Costa met Japanese Prime Minister Shigeru Ishiba.

Among the conclusions of the meeting were commitments on closer cooperation regarding economic security and competitiveness, from critical raw materials to emerging technologies like semiconductors. The timing is no accident. Both the EU and Japan are navigating a more fragmented world where the rules of global trade are increasingly shaped by geopolitical rivalry.

Between US-China tech decoupling and a growing scramble for critical raw materials, Brussels and Tokyo face a similar challenge: how to remain competitive, innovative, and secure in a world no longer governed solely by market efficiency.

The case for semiconductors

No sector captures this shared dilemma more clearly than semiconductors. For the EU, which is striving for digital sovereignty and economic resilience, Japan can be both an ally and a roadmap. Japan, like Europe, once found itself sidelined in the semiconductors race, having lost ground in the 1990s to the US and later to Taiwan and South Korea. Yet in recent years, Tokyo has orchestrated an impressive rebound by deploying targeted industrial policy, public-private collaboration, and strategic international partnerships.

Both the EU and Japan approach economic security through principles of promotion, protection, and partnership. But Japan has taken a more comprehensive approach than the EU so far – especially when it comes to revitalising the semiconductor ecosystem.

President of the European Council António Costa, Japanese Prime Minister Shigeru Ishibia, President of the European Commission Ursula von der Leyen during the EU-Japan summit on 23 July 2025. Credit: EU

In 2021, Tokyo appointed its first Economic Security Minister. Just a year later, the Economic Security Promotion Act was enacted. The legislation positioned semiconductors as not just an industrial concern, but a strategic one, allowing Japan to justify interventions into semiconductors as a matter of both competitiveness and national security.

This comprehensive strategy has already yielded results. Japan has pledged at least €55 billion to boost domestic semiconductor and AI industries and aims to reestablish high-end chip production by 2027. This approach offers important lessons for Brussels.

Europe’s semiconductor challenge

The EU’s semiconductor ambitions – anchored in the EU Chips Act – have been slower to take off. Regulatory complexity, energy prices, and fragmented national priorities are delaying progress toward the bloc’s 2030 production targets. While the EU is committed to increasing its global market share in chip manufacturing, its current toolkit is less agile and less well-funded than Japan’s.

Part of the challenge lies in institutional constraints. The Commission must balance state aid rules, legal and environmental standards, and divergent member state interests—making a decisive industrial policy more difficult. In contrast, Japan’s model demonstrates how aligning national urgency with international partnerships can move policy from planning to production.

Learning from Tokyo: execution and alliances

There are concrete areas where the EU could draw inspiration from Japan. One is alliance-building. Japan’s evolving “Chip 4” network – which includes Taiwan, South Korea, the Netherlands, and the US – focuses not just on market access but on skills, R&D, and supply chain resilience. Japan is not merely protecting its domestic producers but embedding itself in a web of trusted partnerships.

This stands in contrast with the EU’s historically trade-centric approach.

EU-Japan summit on 23 July 2025. Credit: European Union

Another is public financing. Aside from significant investments in national semiconductor manufacturers, Japan Organisation for Metals and Energy Security (JOGMEC) is an independent organisation cooperating with the Japanese government to secure the public funding for critical raw materials and energy needed in chipmaking. Trade Commissioner Maroš Šefčovič has previously pointed to JOGMEC as a possible model for the EU’s own stockpiling efforts under the Critical Raw Materials Act.

These examples show how Japan blends long-term strategic planning with institutional innovation. Europe should take note – not to replicate the model wholesale, but to adapt elements that can work within its own governance context.

What EU brings to table.

The EU also has things to offer. It already has comparative advantages in automotive chips, power semiconductors, and advanced research. Institutions such as IMEC in Belgium and CEA-Leti in France are global leaders in next-generation technologies. Collaborations are already underway – such as the partnership between Japan’s Rapidus and IMEC – showing how knowledge-sharing can translate into industrial capacity.

Rather than attempting to “do it all,” the EU would do well to focus on areas where it is indispensable (particularly in R&D, design, and high-reliability chips), while anchoring its strategy in deeper collaboration with like-minded partners like Japan.

Toward a competitive alliance

Japan and the EU share a set of structural vulnerabilities: limited domestic resources, ageing populations, the risk of technological dependence and high exposure to global supply chain shocks. But they also share strengths – rule-of-law governance, public trust, and advanced science ecosystems. The EU, like Japan, must now move from diagnosis to treatment – including through public-private cooperation, appropriate funding and strategic partnerships with likeminded countries.

Here, the upcoming “competitive alliance” between the EU and Japan can play a pivotal role. With semiconductors at the heart of every strategic sector, from energy to defence to AI, this is a race neither Europe nor Japan can afford to sit out. By learning from each other, they may just stand a better chance of winning it.

Clyde Kull is the former Estonian Ambassador to the EU.