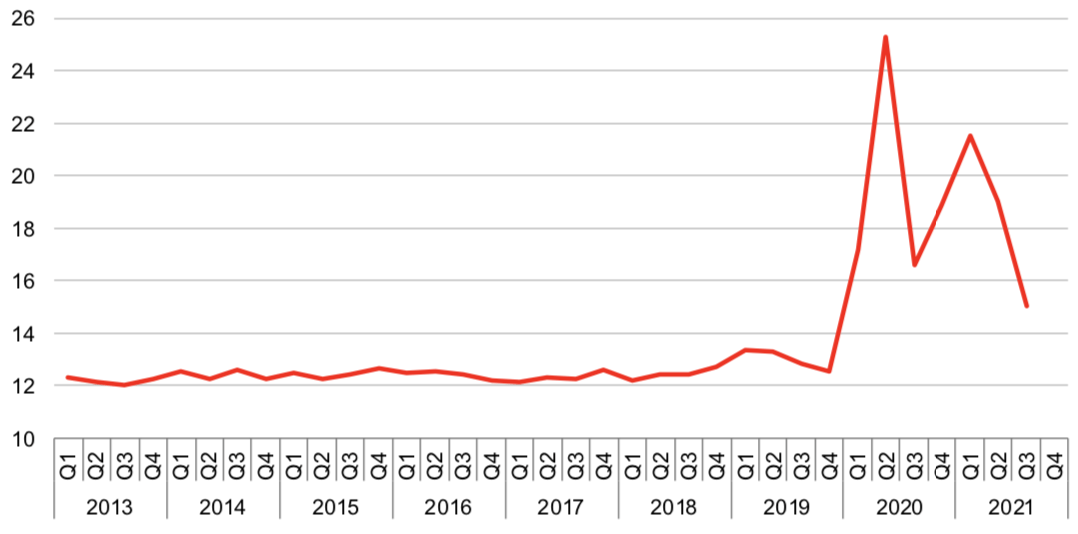

In the third quarter of 2021, people living in the eurozone saved the least since the start of the pandemic but overall they still saved more than before the pandemic.

In the third quarter of 2021, the household savings rate in the eurozone stood at 15%, down from 19% in the second quarter, according to the latest figures from Eurostat, the European Union's statistical office. This is the lowest value since the outbreak of the Covid-19 pandemic.

However, this percentage remains higher than any other value reflecting household savings recorded before the pandemic, between 1999 and 2019.

Household saving rate in the euro area. Credit: Eurostat

The main reason for the decrease in this value is the fact that the expenditure of people living in the eurozone increased by 5.8%, while the gross disposable income of households increased at a lower rate of 0.8%.

In Belgium, people continue to save via savings accounts despite historically low interest rates. The inflation in rate in Belgium is actually much higher than the interest rates on such accounts, as a result of the increased energy prices, which sharply reduced the real value of balances on savings and current accounts.

As a result, people saving in Belgium collectively lost some €22 billion last year as the real interest rate (interest minus inflation) on savings and current accounts came to -5.6% and -5.7% in 2021.

Across the eurozone, investments, in housing or renovations, remained stable throughout both quarters, around 9.6%. This is the highest household investment rate since the second quarter of 2009.