Property rents in Brussels have skyrocketed in two years with the supply of rental housing at cheaper, affordable prices shrinking. As a result, living in the Capital Region is becoming a financial challenge for many households.

Those signing rental contracts in 2023 paid an average of €1,249 per month, almost €100/month more than in 2022 and representing a record rise of 8.6%, an analysis of more than 8,600 lettings by the Confederation of Real Estate Professionals (CIB) showed. Brussels rents have never risen more sharply than between 2022 and 2023.

The jump in price was even more pronounced when looking at the median rent, which rose 10.6% in 2023. This comes on top of the 4.7% rise recorded in 2022 and means that the median cost of rental housing has gone up by over 15% in just two years.

"The median figures show that the Brussels rental market has become a lot less affordable in a short time," CIB communications director Kristophe Thijs said. "The supply of rental housing at affordable prices is shrinking."

All properties less affordable

Only 7.1% of all lettings in the Brussels-Capital Region are €700/month or lower. Just 27.3% were less than €900 per month. By comparison, in 2021 15.5% of all leases were signed at less than €700 and 43.2% were below €900, not including costs and charges.

"It is increasingly difficult for tenants to find housing with low rents. If you look at the one-third rule of thumb [that households should spend around one-third of their income on rent], you can see how quickly low-income people are left out, especially if there is a lot of competition," Thijs said. "And that is the case: real estate offices indicate that the number of applicants per rental property continues to rise."

The municipality of Saint-Gilles saw the biggest hike in rents with an increase of more than 17%. The average monthly cost for a flat here is now €1,223. This was followed by Neder-over-Heembeek (+13.8% to €1,054) and Woluwe-Saint-Lambert (+12.1% to €1,301).

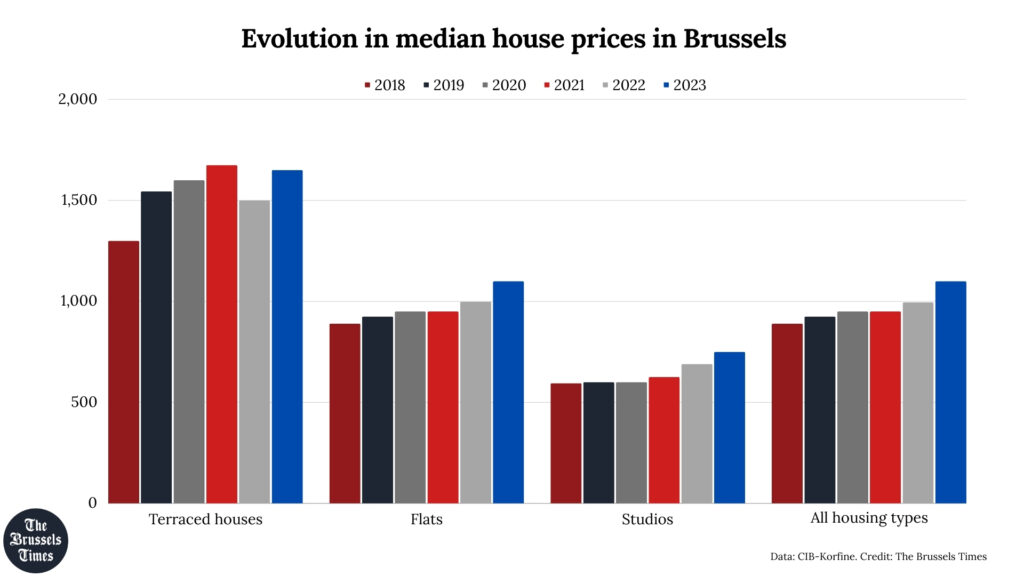

Prices increased for all housing categories, although for terraced houses there was a more marked fluctuation in average rents and the average price in 2023 is still below that of 2021.

Thijs explains that "terraced houses are hardly rented out in Brussels anymore so are prone to greater fluctuations. Their number in Brussels is diminishing at breakneck speed. Through real estate agencies, this amounts to about 500 terraced houses per year," Thijs said. Due to the low number of lettings, there may be distortions.

In most housing categories the price trends reflect that seen for flats, which are by far the most important housing type, accounting for 9 in 10 lettings in the Brussels region.

More than inflation

Though remarkable, the rise in rental prices in 2023 was not unexpected. "The rental market had not yet fully absorbed the inflation shock. By comparison, inflation ran at 11% in 2022, but average rents rose by only 3.9%." This is because the property market is not structured to absorb such shock effects immediately. Prices adjust only according to the pace at which properties enter the market, meaning the impact is delayed.

"We knew that a catch-up was coming in 2023," Thijs stated. The same phenomenon was seen in Flanders (4.9% increase in 2022, and 6.4% in 2023). Only in Wallonia does the impact of inflation already seem to be winding down (+4.8% in 2022 and "only" +4.3% in 2023).

However, at 8.6%, Brussels is especially affected by the rise in rents, especially given that in 2020, 2021 and 2022, the increases in Brussels were actually lower than in the other regions. "In 2023, that trend is reversed. With a total increase of 14% over the past two years, the price level is also above inflation," Thijs said. Brussels was also the only region where the rise in rents was above inflation.

"Inflation is the big driver, but there are other factors at play," Thijs told The Brussels Times. "These include house prices (investor returns), huge scarcity in the market, and the drying up of incentives for property investors, among others."

Related News

- 'Brussels Paradox': A wealthy region with an 'acute' housing crisis

- Property prices in Belgium continue to rise, but fall in neighbouring countries

Real estate offices have warned that there are fewer rentals and investors are leaving the Brussels market. "This is due to a deadly cocktail of high investment costs – the housing stock is outdated – changes in interest rates and a policy that is repelling investors rather than attracting them."

These figures highlight the fundamental challenges facing the Brussels housing market. According to the CIB, the primary need is for a greater number of affordable properties. "For this, the government desperately needs private investors. Unfortunately, it is not showing that today in Brussels, quite the contrary," Thijs warned.

The CIB pointed to decisions made by the region such as a winter moratorium (where defaulters cannot be evicted during winter), tenants' preferential right when selling the property, restrictions on rent indexation and fears of rent control in the region. "Investors do not see an outstretched hand to stay or become active in Brussels," Thijs concluded.