Foreign direct investment (FDI) in Europe slumped to a nine-year low in 2024. While the investment picture in Belgium is still far from ideal, it remains among the continent’s top ten investment destinations, spurred by a rebound in job creation, strong port infrastructure and an agile SME sector.

New figures from consultancy company EY’s Europe Attractiveness Survey 2025 show that FDI project numbers across Europe fell 5% last year, with job creation slumping 16%, a third straight annual decline. Economic stagnation, high energy prices and geopolitical disruption have all contributed to the downturn. But Belgium, though not immune, has fared better than many of its peers.

In 2024, Belgium attracted 210 FDI projects, a slight decline of 2% compared to the previous year. That was less severe than the drops seen in France (-14%), the UK (-13%) or Germany (-17%). More notably, job creation in Belgium rose 10% to 5,392 roles, partially recovering from a steep 39% drop the year before.

"This 8th place is okay and stable," Tristan Dhondt, EY-Parthenon Belgium Leader, told The Brussels Times "But if you look at previous years, when we ranked 5th, 6th, or 7th, you see the decline. Compared to Europe, we’re not doing badly."

"We have the ports of Antwerp and Zeebrugge, and strong air logistics. Lufthansa and TUI have both invested here," Dhondt said. He added that the country benefits from a robust tech and knowledge industry, a high quality of life, and a multilingual workforce. He did however caution that the Belgian economy has become complacent, facilitating investments into R&D activities while neglecting high-tech manufacturing.

Industry woes

Disinvestment in the Belgian economy is still a serious risk. Despite some signs of resilience, the investment climate remains fragile. Across Europe, 37% of companies postponed, cancelled, or scaled back their investment plans in 2024. Of those, 60% postponed, 33% cancelled entirely, and 34% reduced their scope.

"This is the first time the response is so clear," Dhondt said. "The fact that 33% cancelled projects with no alternative location is particularly worrying." Intent to invest in Europe over the next year dropped from 72% to 59%, and only 61% of executives expect Europe’s attractiveness to improve over the next three years, compared to 67% for China and 74% for the US.

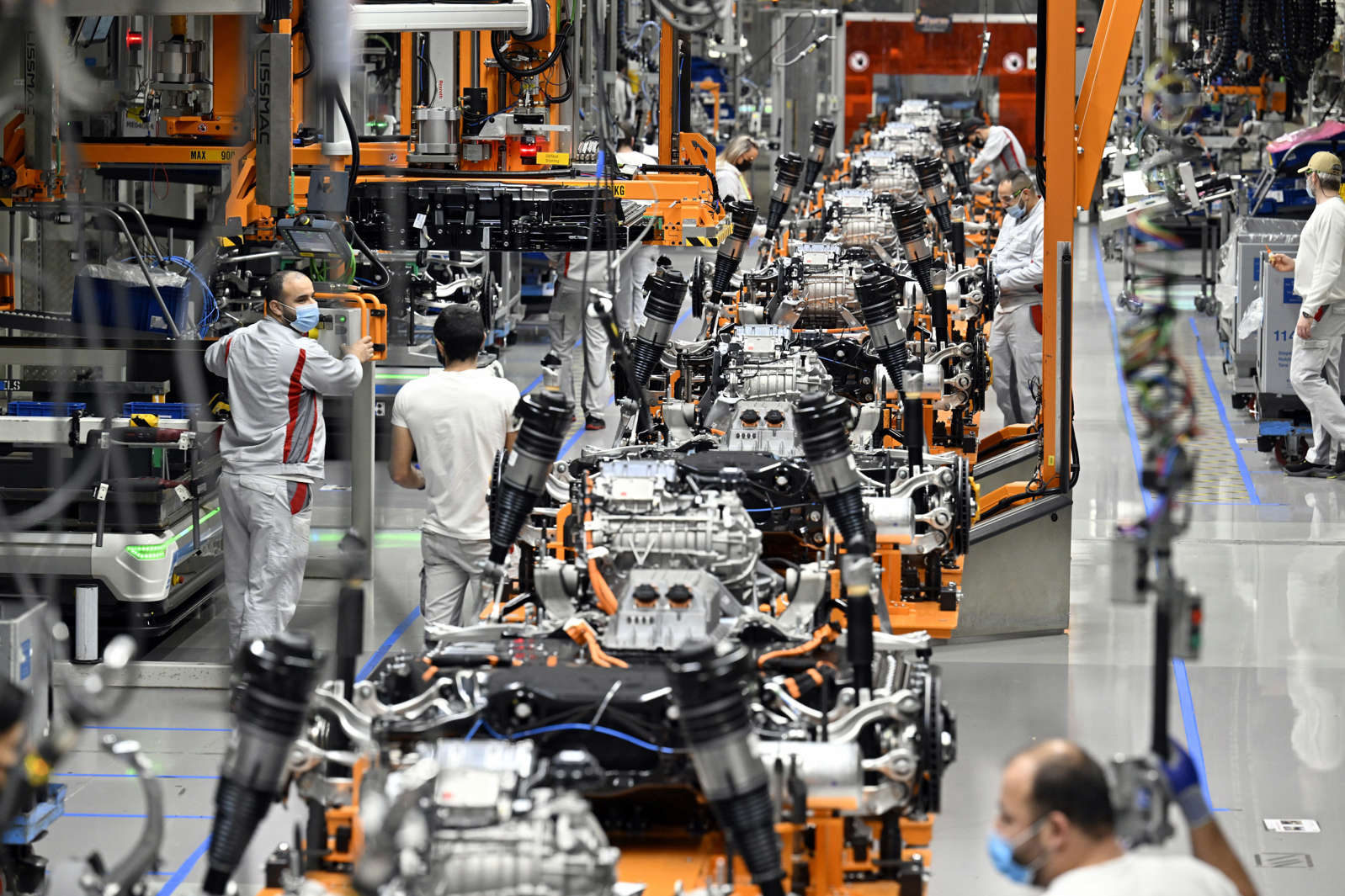

Some well established investments are also at risk, as evidenced by the closure of the Brussels Audi factory, which, while long on the cards, was viewed as a crushing defeat for Belgium’s manufacturing potential.

An Audi electric vehicle assembly plant in Brussels. Credit: Belga

"There are companies pulling out," Dhondt said. "We’ve seen production shift to northern France due to cost and competition." Major industrial players, such as fertiliser company YARA, engineering company Rogers Corporation, and British chemical company INEOS have also declared their intention to withdraw or roll back their Belgian investments.

Belgium saw a drop in total FDI projects from 231 in 2023 to 210 in 2024. While job creation increased last year, the quality of investment varies. Belgium generated an average of 25.7 jobs per project, less than half the European average of 64.

"We’re lower. Yes, some big logistics investments create hundreds of jobs. But then you have headquarters or admin offices… sometimes it’s just one guy. That drags the average down," the EY analyst explained.

High labour costs

One of the largest hurdles to attracting fresh investment into the Belgian economy is its unique wage indexation and high labour costs. For many years, experts have expressed concern that the cost of hiring staff in Belgium is driving down its competitiveness, compared to its European counterparts. At €48.20 per hour, Belgium’s labour costs are among the highest in Europe.

"It’s too high. Simple as that," Dhondt said. Labour cost, alongside burdensome taxes, a lack of fiscal incentives. The EY expert, who helps international firms scout for investment locations, says that these considerations are extremely important.

He also pointed to Belgium’s automatic wage indexation as a double-edged sword. While it ensures a higher quality of life for those working in the country, it also restricts industrial potential. “It has much more of a negative effect. We have to do far more to be efficient than countries with lower costs,” he said.

In Belgium, FDI typically comes from neighbouring European countries, such as the Netherlands, France or Germany, but also traditionally from the United States, which became Belgium’s largest foreign direct investor again, rebounding following a steep decline in 2023.

A factory operated by Procter and Gamble in Belgium. Credit: Belga

Last year, Belgium attracted 43 major investments from the United States, 28 from France, 18 from the Netherlands and 13 from the United Kingdom. New economies are also taking interest in the Belgian economy, with the number of investments from India rising by 300%.

Across the continent, investor sentiment is cooling. The Eurozone grew by just 0.7% in 2024, while the US posted 2.8% and China 5%. FDI fell in both software and manufacturing sectors, with energy costs and geopolitical risk dampening confidence.

According to EY’s data, the number of announced projects from US firms fell by 24% over two years. Meanwhile, the US saw a 20% increase in greenfield projects, driven by incentives such as the Inflation Reduction Act and CHIPS Act. "The economic uncertainty is very high," Dhondt said. "And that makes companies hesitate, not just in Europe, but globally."

Dhondt sees structural issues within the EU as part of the problem. "We’re not harmonised on taxes or policy. Investors can shop around, we’re competing with each other instead of acting like one continent," he said.

He believes this fragmentation is particularly damaging during periods of economic uncertainty. "We don’t have a common goal. That’s what makes the crisis more difficult to handle."

New opportunities

Despite the challenges, Belgium continues to draw FDI into strategic sectors. Manufacturing attracted 55 projects in 2024, and logistics 53, both outperforming business services, which dropped to 35. Regional disparities persist. Flanders attracted the most projects (137), while Wallonia held steady at 29. Brussels, the only region to see an increase, brought in 44 projects.

Still, the capital struggles to compete. “It’s always way behind,” Dhondt said. “It’s harder to attract projects. Tax burdens, limited space, and budget constraints play a role.” He added that projects in Brussels typically create very few jobs — averaging around 1.5 per project.

Other sectors continue to be attractive options for foreign investors. “Logistics and transport are important for Belgium,” Dhondt noted, referencing recent investments from DSV, Lufthansa and TUI.

Illustration shows a visit at the John Cockerill Defence site in Loncin, Wednesday 08 June 2022. Credit: Belga/ Eric Lalmand

Defence-related FDI is also rising, with Thales expanding in Belgium’s Herstal and similar activity seen across Europe from firms like Rheinmetall and BAE Systems. New investments from the French aerospace multinational are set to quintuple missile production at the Herstal site. Dhondt believes Belgium should seek investment in what it does best, technology manufacturing.

Related News

- Flanders wants EU to focus on core tasks - security, competitiveness

- Brussels’ office bailouts: Empty floors, full price, no spies

- Multinational firms hold key to a third of Belgian jobs

"We’re good at tech manufacturing, including in defence. Not just munitions, but also critical tech infrastructure," Dhondt said. He also framed defence more broadly, as a sector that includes disaster-response infrastructure and strategic materials.

Belgium, he believes, should focus on "tech manufacturing 2.0", in line with the new European Industrial Deal. This involves rapid reindustrialisation fuelled by sustainability and new approaches to high-tech production. "We should double down on those areas," he said.

Despite the mixed forecast, early indicators and estimations suggest that investors are quietly confident about the prospects of the Belgian economy. The national survey found that 70% of investors expect the country’s attractiveness to improve, up from 66% the year before. “Belgium is going against the broader trend,” Dhondt said.

He sees early signs of recovery. "My barometer is transactions. And activity is coming back compared to the last quarter of last year. I’m more positive going forward."