Belgian investors are embracing Exchange-Traded Funds (ETFs) at record levels: at the end of last year, 76,000 Belgian investors were trading in this product, according to new figures from the Financial Services and Markets Authority (FSMA).

ETFs – also called "trackers" – are a specific form of listed index funds (which are mutual funds that try to mirror the performance of an index or benchmark as faithfully as possible), which are more liquid than traditional mutual funds, as people can trade them daily on the stock exchange.

"These funds track a stock market index as closely as possible. If that index (such as the Bel20, for example) rises or falls, the tracker will also rise or fall," the FSMA explained. "It is a form of passive investing that is becoming increasingly popular."

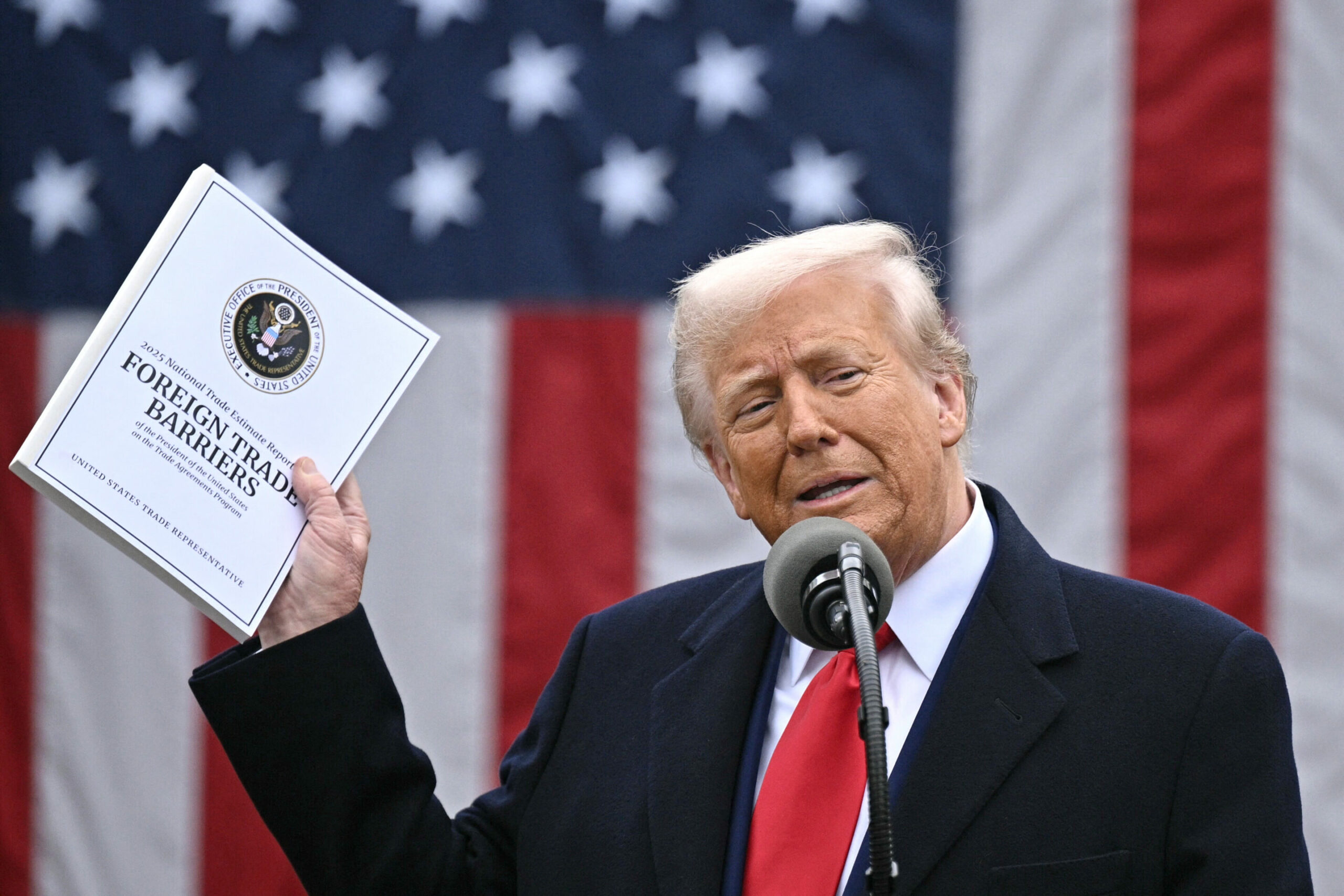

The growth in popularity is partly due to the increased interest in Artificial Intelligence (AI) and Donald Trump winning the election to become the US President. Many ETFs track an American stock market index, which means that these funds are highly sensitive to the evolution of the US economy in general and the financial markets in particular.

US stock markets were down on Easter Monday 2025 as Donald Trump continued his criticism of Federal Reserve Chair Jerome Powell. Credit: Belga / AFP

Last year, over 40% of the total value traded was in North American stocks – the highest share in five years – while the share of Belgian and European equities reached a multi-year low.

The last quarter of 2024 saw 19,000 new people investing in ETFs – with this surge reflecting a broader shift in retail investing habits. These kinds of transactions rose by over 80% year-on-year to 207,000 in the last quarter of 2024 – outpacing growth in stocks and bonds.

They are also gaining traction among first-time investors: of the Belgians who entered the market in October-December, around 19,000 chose ETFs as part of their first trade. "This underscores their growing role as a gateway to capital markets."

How much does it cost to invest in ETFs?

When buying an ETF, you pay the same costs as when buying a share on the stock exchange. This means they differ from institution to institution.

As banks or stock exchange companies charge costs to execute purchase and sale orders, you will have to pay a brokerage fee. "Most trackers are listed on a foreign stock exchange. The brokerage fee for this is higher than for a purchase or sale on the Brussels stock exchange."

The bank or stock exchange company places a purchased tracker on your securities account. Sometimes it is free, but a custody fee is usually charged for this. Lastly, it is important to keep the exchange rates in mind. "Trackers are sometimes listed in foreign currencies such as US dollars. In that case, you must take the exchange rates into account."

Just like "classic" funds, trackers also charge annual running costs. However, they are much lower and usually fluctuate around 0.40% (compared to around 2% or more for traditional ones).

Advantages and disadvantages

One of the biggest advantages of investing in ETFs is the low management costs. Passively following an index is less labour-intensive than actively selecting the right shares, which is why costs are lower for trackers than for traditional funds (as stated above).

Additionally, trackers have a clear price that can be set at any time of the day. Because trackers are listed on the stock exchange, you buy and sell at the stock market price at that time. With traditional investment funds, it often takes a few days before you know how much you pay or receive for a purchase or sale.

Lastly, the golden investment rule "don't put all your eggs in one basket" can be perfectly applied. Via ETFs, you can invest in just about anything in one transaction and with small amounts, the price or rate of which is determined by a market mechanism.

Stock exchange. Credit: Belga/Nicolas Maeterlinck

However, opting for trackers also comes with risks. People can lose (part of) their capital when investing in trackers; there are no trackers with capital protection on the market.

Selling can sometimes be difficult as well. Although trackers are listed on the stock exchange, finding a counterparty is not always guaranteed if you want to sell. Check whether a tracker is sufficiently tradable before you buy one.

Additionally, while people think they are diversifying by investing in ETFs, yet sometimes they have a strong concentration of a few large stocks in a particular index. "So your investment in an index may be (too) dependent on the performance of a limited number of stocks. Check carefully the weighting of all constituents of the index before investing in it."

Lastly, trackers in commodities require special knowledge about the commodity in question, as these markets do not always follow the same logic as traditional investment markets. Commodity markets are very diverse, while price formation is far from intuitive and in some markets prices are very volatile.