Nearly 515,000 VAT-registered companies in Belgium have yet to join the Peppol network to comply with the mandatory electronic invoicing requirements set for 1 January 2026,

This is according to data from the Ministry of Finance, which cites figures as of 28 November.

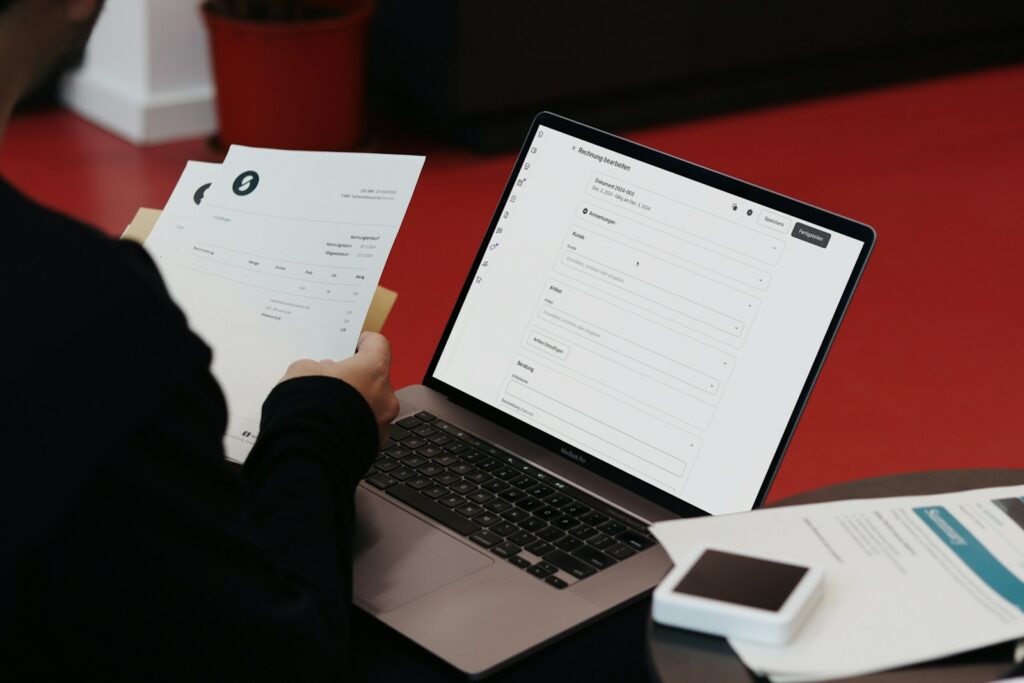

From the start of next year, electronic invoicing will become obligatory for business-to-business (B2B) transactions via automated software, meaning PDF files or emails will not be valid anymore.

This requirement will also apply to companies dealing exclusively with individual consumers.

The measure, approved by Belgium’s Chamber of Representatives in early 2024, includes penalties ranging from €1,500 to €5,000 for non-compliance.

Currently, 515,530 companies are registered on the Peppol network. However, more than half of businesses still need to complete the registration process by 31 December to avoid penalties, said Florence Angelici, spokesperson for the Ministry of Finance.

Angelici also noted that the number of registrations is steadily increasing, as many companies had intentionally delayed joining—a pattern observed in other countries where similar requirements were introduced.

A temporary three-month grace period will be in place at the start of the year. No penalties will be issued to businesses that initiate compliance measures before the law is fully enforced.

However, companies that delay their efforts until after 1 January may face sanctions, Angelici warned.

For self-employed workers, simple and low-cost solutions are available that typically require only a few minutes to set up. Angelici encouraged businesses to contact their accountants or industry associations for guidance.