In 2017-2019, imports of Russian goods accounted for, on average, 1.5% of Belgian GDP, according to the National Bank of Belgium. Though Russia is only the tenth-largest source of imports for Belgium, the business it brings is valued at roughly €6.7 billion per year.

Statistics presented by the National Bank of Belgium on trade with Russia are representative of the balance of trade with Russia before the introduction of sanctions.

The four packages of sanctions imposed by the European Union have already slashed both direct and indirect trade with Russia. Many international companies have since left the Russian market.

Nevertheless, it is important to assess the levels of trade to understand the possible impact that sanctions may have on the Belgian economy.

In 2021, the bank estimated that around 1,500 Belgian companies export goods to Russia; around 1,000 export from Russia. Belgium’s trade to GDP ratio in 2020 was 160.71%, which shows how Belgium heavily relies on free trade to strengthen its economy.

Belgium less reliant on Russian trade

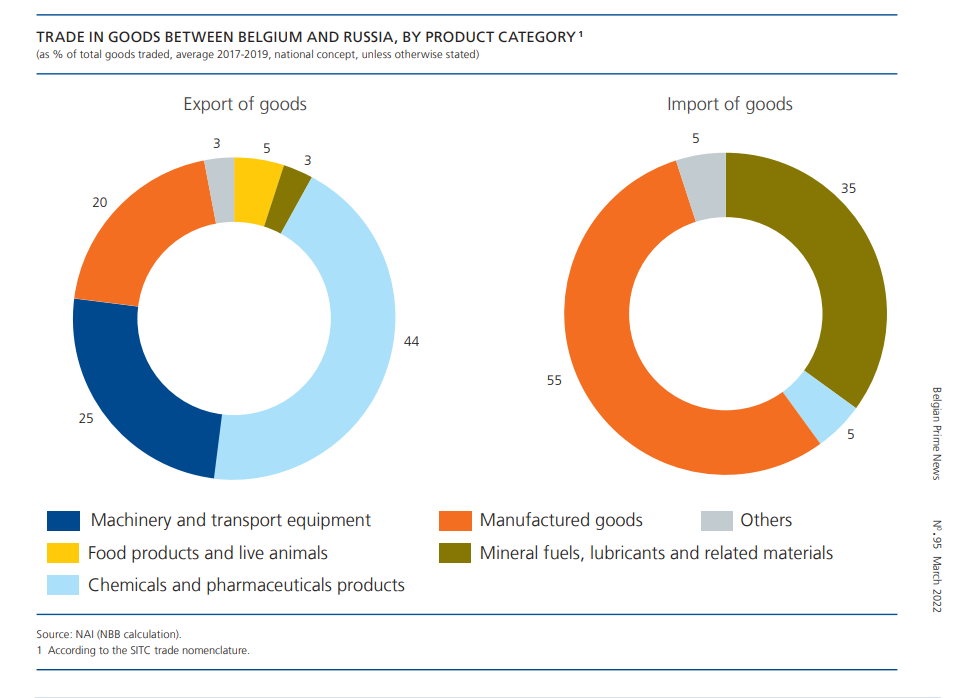

In terms of economic dependence on Russia, Belgium is in a relatively privileged position. While much of Europe imports massive amounts of Russian fuels and derivatives, Belgium is much less reliant. Fuel imports accounted for just 35% of trade with Russia in 2017-2019.

According to the National Bank, Belgium has “relatively little direct dependence on Russian gas, which only accounts for between 3-6% of Belgian consumption.”

In Germany, on the other hand, crude oil and natural gas from Russia accounted for roughly 59% of its share, while 30% of its total gas needs are imported from Moscow.

Imported Russian goods in Belgium mostly consist of manufactured goods (55%). According to the National Bank, these are mostly “manufactured non-metallic mineral articles.”

Credit: National Bank of Belgium

The National Bank notes that there are some areas in which Belgium is still reliant on Russia. “In terms of imports into Belgium, certain types of products indicate greater dependence on Russia. This is particularly the case for imports of some particular raw materials such as coal, iron and steel,” the bank states.

Hooked on diamonds

The National Bank’s findings, however, seem to overlook important dynamics in trade between Russia and Belgium. The bank’s data uses averages recorded between 2017-2019, deliberately excluding the last two years, which it describes as “exceptional.” It also makes no reference to a lucrative trade: the import of Russian diamonds.

According to OEC data, the diamond trade accounted for over 25% the value of exports from Russia to Belgium in 2020. The Belgian diamond import industry was worth around $1.45 billion, representing Belgium’s second-largest source of Russian imports after fuels.

In a speech to the Belgian parliament, Ukrainian President Volodymyr Zelensky criticised the Belgian government for valuing diamonds sold in Antwerp over the lives of Ukrainians.

The Russian diamond industry, dominated by partially state-owned company Alrosa, has close connections to the Russian nuclear sector.

Belgian Prime Minister Alexander de Croo has resisted calls to end trade with Russia, stating that halting the lucrative purchase of diamonds would have a stronger impact in Europe rather than in Russia.

The Belgian diamond industry has stated that it is opposed to any sanctions over fears that the industry will relocate elsewhere. According to advocacy groups such as Promote Ukraine, this shows that Belgium is still reliant on some Russian products.

Sanctions to sting Belgian businesses

The export of Belgian goods to Russia amounts to just 0.7% of GDP. Russia is only Belgium’s 17th largest trade partner for exports.

In 2017-2019, Belgium exported an average of €2.6 billion to Russia. However the bank does not dismiss that this figure may be larger. Many Belgian goods travel to Russia through other economies.

“Indirect flow via other countries could also mean that Russia is the final recipient of Belgian exports, or conversely the origin of its imports,” the bank states.

Related News

- European leaders plan further sanctions on Russia

- Protests against trade of Russian diamonds in Antwerp

According to the National Bank, 44% of goods exported from Belgium between 2017-2019 were chemicals and pharmaceuticals. Belgium is a leading producer of medicinal and pharmaceutical products, which account for over half of total chemicals exported to Russia.

In previous years, Belgium sold significant numbers of cars to Russia. Belgium is home to two car assembly plants, the Volvo plant in Ghent, and the Audi plant in Brussels. Belgium also exported buses and trucks from both domestic and local companies.

The bank assesses that trade between the two countries is not enough for Belgium to become dependent on Russia, and therefore subject to economic demands.

“It appears that Belgium has little exposure through its direct trade flows with the Russian Federation and does not seem to be dependent on Russia,” the bank concluded.

While trade between Belgium and Russia is satisfactorily low, the bank warns that any significant disruption could have far reaching effects. Strict sanctions imposed on Russia could risk hurting Belgian businesses, especially in the context of rapidly rising inflation.

“Even if direct and indirect trade relations between Belgium and the Russian Federation are quite limited, any reduction or complete halting of commercial relations with Russia would obviously have significant consequences for the Belgium economy.”