The number of houses and flats that were purchased and sold in Belgium last year dropped slightly compared to 2021, with a particular cooling off of the market in the second half of the year.

Following a rapid rise in the number of transactions during the first nine months of 2021, driven by a wave of purchases which saw property prices increase, the market in Belgium cooled slightly in 2022, with transactions falling 2% compared to the previous year.

The findings were highlighted in an annual property barometer published by the Federation of Notaries (Fednot) on Thursday.

"The drop in activity is due to a cocktail of rising interest rates, hefty energy prices, inflation and the war in Ukraine," said Notary Bart van Opstal, spokesperson for Notaris.be.

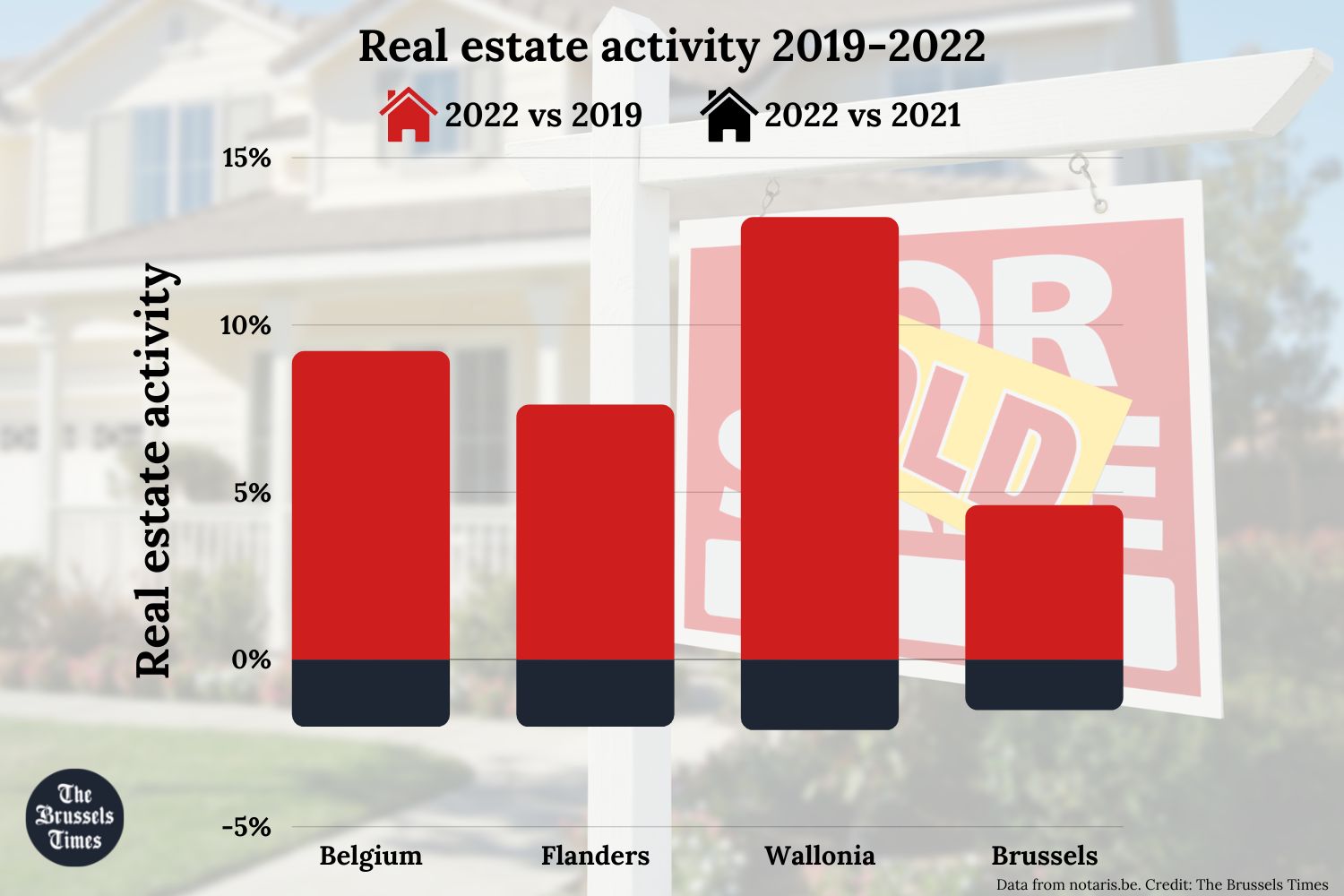

Flanders also saw a 2% fall in real estate activity compared to 2021. The drop was slightly lower in Brussels (-1.5%) and higher in Wallonia (-2.1%).The reduction in transactions became more pronounced as the year went on with 7.1% less activity in the second six months compared to the first.

Despite this decrease, the number of transactions in 2022 was still "quite a bit higher than in the pre-pandemic period," Fednot stressed. Compared to 2019, there were +9.2% more transactions last year, an upwards trend recorded in all three regions: +7.6% in Flanders, +4.6% in Brussels and +13.2% in Wallonia.

Is property more or less expensive?

As was confirmed by the barometer last month, property prices in Belgium continue to increase but less quickly than inflation. The average cost for a house in Belgium is now around €319,000 – about 8% higher than in 2021. Yet accounting for inflation, this was really a price decrease of -1.8%.

The average cost of a flat in Belgium was €260,300 (+3.6% vs 2021); accounting for inflation this was a price decrease of -6.4%. Wallonia saw the biggest increase in the price of a flat, followed by Brussels and Flanders.

Related News

- Flanders frees €575 million for construction of 6,000 affordable houses

- Explained: What support can you receive in Belgium for energy-efficient renovations?

In Belgium's neighbouring countries, house prices have dropped. For the first time in nine years, the Netherlands saw house sales prices fall in the fourth quarter (down 6.4%), the Dutch Association of Estate Agents (NVM) announced. It put this down largely to increased mortgage interest rates, which mean buyers can borrow less.

In Germany, too, prices for residential property dropped for the first time in over a decade, according to data released by the mortgage technology provider Europace AG and published by Bloomberg on Thursday, highlighting the pressure on the market since the European Central Bank (ECB) started increasing interest rates.

Belgium remains less impacted by these changes due to its credit policy, which dictates that very risky credits are not granted.

Young buyers 'remarkably' active

As has been the case since June last year, young people continue to be remarkably active in the property market. The proportion of young buyers increased compared to 2021, resulting in a total of 30.3% of buyers being 30 years or younger (up from 27.9% in 2021).

"A lot of young people decided to buy in 2022, supported by family or not, because they expect interest rates to rise even more in the coming period," explained van Opstal. The average age of a person buying property in Belgium last year was 39.2 years old on average, compared to 39.9 years in 2021.

Young buyers were mainly active in Flanders (32.2%). In Brussels, the share of young buyers in 2022 was 21.5%, while in Wallonia, this figure stood at 28.3%.

Finally, the barometer identified energy efficiency as an important factor, with poorly insulated homes dropping in value. Properties with the best energy label (EPC score A or B) were highly sought after and rose most in value.

"For home buyers, a good score means lower consumption costs, for investors the added value and rental value is higher," van Opstal concluded.