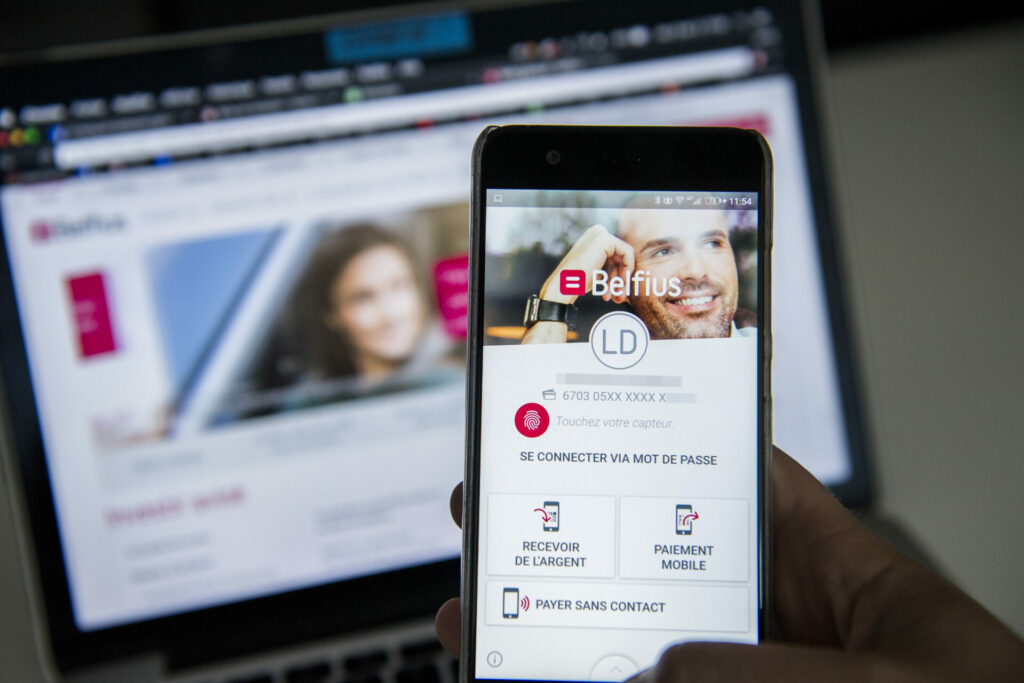

Phishing, a form of online fraud that targets people's bank details, is becoming increasingly prevalent as perpetrators become more cunning. Banks are now stepping up their efforts in the fight against this crime.

In 2021, over 40% of Belgians were victims of phishing, highlighting the need for more proactive steps to be taken. Now, people who fall victim to phishing can now contact their banks day and night to have all their payment apps blocked. The measure was announced by the State Secretary for Consumer Protection Alexia Bertrand, who called for it in October last year.

"This is very good news. We saw that phishers often struck after office hours, just because they could then go about their business for a few hours. That will now be a thing of the past," Bertrand noted in a statement on Monday.

While it was already possible for victims to have their bank card blocked at any time via Card Stop (on the free number 078/170 170), shutting off access to mobile banking apps was more difficult.

Febelfin, which represents the Belgian banking sector, informed Bertrand that all retail banks have now provided 24/7 accessibility, including by phone, to block those payment apps.

"Cybercriminals can strike at any time. Rapid notification of suspected fraud by consumers is then essential to limit as much fraud as possible," Karel Baert, CEO of Febelfin, said. "Hence this initiative by the banks, in consultation with the government."

Continued battle

The phenomenon of criminals trying to extort money or data from someone by luring the victim to a fake website via e-mails is definitely not new, but perpetrators are becoming more cunning and victimising more and more people. While official figures show some 10,000 reports of phishing, the actual number of victims may be much higher, as not everyone reports it to the FPS Economy Hotline.

Bertrand, like her predecessor Eva De Bleeker, advocates a system of slow banking, which would see banks provide stronger payment limits so that phishers would have a harder time to be able to steal large sums of money.

Related News

- Over four in ten Belgians victims of phishing last year

- Delivery fraud 'wave' has hit Belgium: Here's how to avoid becoming a victim

Meanwhile, the Belgian financial sector is creating an IBAN name check to combat invoice fraud, a form of scam in which fraudsters manage to falsify the invoice of a genuine merchant by replacing the account number with their own.

This would see checks being carried out whether the name of the beneficiary effectively matches the name of the account holder.