In a much-anticipated release, Eurostat, the European statistical office, has offered a glimpse into the European real estate landscape for the second quarter of 2023, and the findings are nothing short of remarkable when compared to the situation back in 2010.

Housing prices across the European continent showed a notable uptick of 0.3% during the second quarter of 2023, as revealed by Eurostat. In tandem with this trend, rents also experienced a notable rise, with an increase of 0.7%. While these percentage increases might appear modest at first glance, it is crucial to consider them in the context of the previous year's data, where housing prices had slumped by 1.1% and rents had surged by 3%.

Eurostat's analysis suggests that this recent pattern mirrors what was observed during the period between 2010 and the second quarter of 2011. Since then, housing prices have undergone significant fluctuations, while the cost of renting has consistently surged. This serves as a clear indicator of the mounting pressures on the European rental market, witnessed not only in Belgium but throughout the continent.

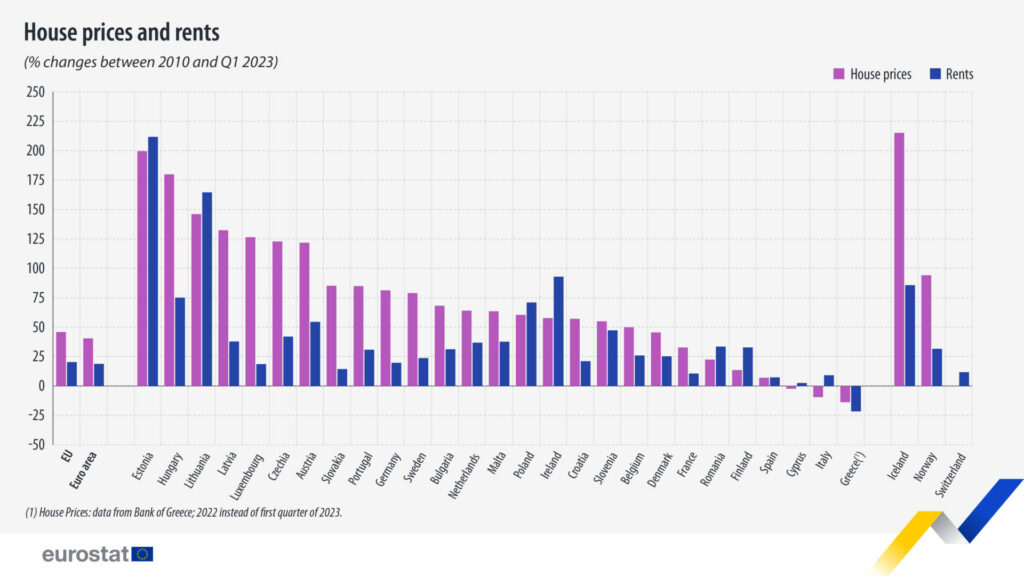

Notably, housing prices had declined for two consecutive quarters before embarking on a slight upward trajectory. Perhaps the most striking revelation lies in the long-term trends; between 2010 and June 2023, European housing prices have soared by an astonishing 46%, with rent costs ascending by 21%. The most substantial price hikes were recorded in countries such as Estonia (+211%), Hungary (+180%), Lithuania (+152%), Latvia (+144%), the Czech Republic (+122%), Luxembourg, and Austria (+120%). Noteworthy exceptions to this upward trajectory were Greece, with a decrease of 14% (2022 data), Italy down by 8%, and Cyprus witnessing a 3% reduction in prices.

In the case of Belgium, over the same period from 2010 to the present, housing prices have surged by just under 50%, while rents have seen a significant 25% increase. To illustrate the magnitude of this change, a property valued at €200,000 in 2010 is now estimated to be worth €300,000, reflecting an annual increase of €7,600. For a property initially valued at €300,000 in 2010, its current value stands at €450,000, signifying an annual increase of €11,500.

Regarding rental costs, they witnessed an upswing in 26 European countries, with the most significant spikes occurring in Estonia (a staggering 208% increase) and Lithuania (a substantial 168% rise). The sole exception to this upward trend was observed in Greece, where rents experienced a notable decline of 21%.

The data released by Eurostat underscores the dynamic nature of the European real estate market and the profound implications it holds for homeowners, renters, and investors across the continent. The future trajectory of these trends will undoubtedly be closely monitored by experts and stakeholders alike.