Arriving in Belgium can be daunting. While welcoming and well-suited for expats, Belgium is overly bureaucratic and the smallest task – such as opening a bank account – can sometimes feel like an uphill battle.

Fortunately, digitisation, online banking and competition from new fintech start-ups mean that Belgian banking is increasingly high-tech and user-friendly. With The Brussels Times' handy guide, newly-arrived expats can start banking like a local.

Why open a bank account in Belgium?

It is perfectly possible to live in Belgium without a Belgian bank account, and many chose to simply forgo the process in favour of purely digital banks such as Revolut or Wise. These typically allow users to receive Belgian salaries, withdraw money and make transfers to Belgian accounts.

While this has its advantages, lacking Belgian account numbers can cause issues further down the road. For example, many health insurance companies, gyms, and other subscriptions will require a Belgian IBAN number for reimbursements and payments. Likewise, starting a phone contract is often not possible without a Belgian bank account.

Belgian bank accounts certainly have many benefits and enable users to truly pay like a local. Payconiq, which is now widely available at most Belgian banks, allows users to instantly send money to each other using QR codes. In lieu of traditional card terminals, many businesses now use the system to accept payments. Without a Belgian bank account, many expats are locked out of this convenient payment option.

Credit: Belga / Thierry Roge

Major banks also offer increasingly attractive savings and investment accounts, and are catching up with the online banking trend. Many now offer complimentary pre-paid cards allowing for affordable international spending and withdrawals.

Belgian bank accounts aren't without their pitfalls, however. The number of physical bank branches is in constant decline across the country, Belgium's affinity for Bancontact/MisterCash is not shared outside the Benelux (which can cause problems on holiday), and some banks can be reluctant to take on new customers. Despite this, it is typically worthwhile to invest in a Belgian account.

Choosing an account

Expats should first consider which type of account best suits their needs. For most purposes, a standard current account should suffice for everyday banking, such as deposits, withdrawals and transfers. Most banks offer debit cards and online banking. Several also offer free credit cards when opening a basic account.

Students in Belgium may benefit from a student account. These accounts typically have lower fees and offer other perks such as discounts at major retailers or free subscription services.

If arriving in Belgium with a partner or family member, it may be worth investing in a joint account. These allow families to manage their shared expenses and to hold several bank cards associated with one account. Some standard current accounts also now give clients the option to ask for several bank cards for informal expense sharing.

Freelancers in Belgium should consider opening a business bank account. As an entrepreneur, these accounts allow you to separate personal and business expenses and are strongly encouraged by accountants. Furthermore, business accounts often have lines of credit to help support small businesses or freelancers.

Savings accounts can often be acquired in addition to a current account. These provide interest on deposits, which can typically be withdrawn after several years, allowing for long-term financial planning and rainy-day funds.

Choosing the right bank

Before settling on a bank, it is important to browse the market to select the best deals suited to your needs. Some banks offer considerable incentives to join, but may not be the best choice due to high fees and transaction costs. Bank comparison sites such as 'Comparatif Compte Courant' can help refine your search, only showing banks that offer the services that you truly need.

Be sure to search online for real customer testimonials about the level of service provided by the bank's in-branch and online staff. With physical locations rapidly dwindling across Belgium, good digital customer service and online banking services are becoming a must when selecting a new bank.

Some banks will be more suited than others for the needs of expats. If you arrive in Belgium without knowledge of French or Dutch, it is best to find a bank which offers onboarding and customer service in English.

Popular banks

There are a wide array of banks to choose from in Belgium, most of which will have branches in major cities across the country.

Credit: Belga / Lauria Dieffembacq

Some banks may offer slightly different services depending on where they are located (CBC in Wallonia, KBC in Flanders and KBC in Brussels) but their fundamental offering is roughly the same.

Here are some of the best-known banks in Belgium:

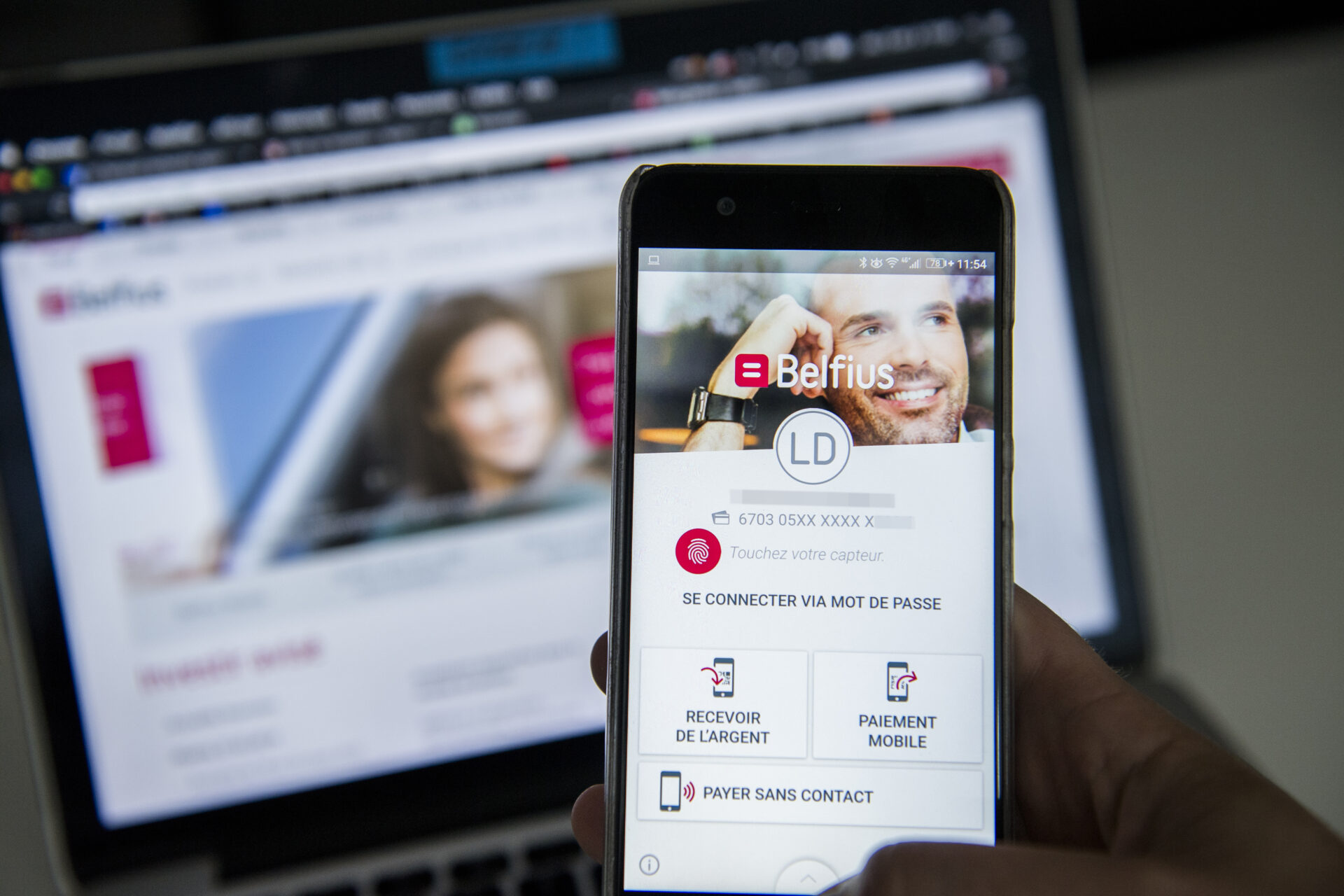

Belfius

As Belgium's largest bank by number of branches, Belfius can be a convenient first choice for expats arriving in Belgium. Belfius offers clients a checking account, up to two debit cards and two Mastercard credit cards, as well as online purchase protection, travel cancellation insurance and discounts. Clients can use the Belfius apps to manage their finances easily.

KBC/CBC

KBC is a particularly safe choice for banking in Belgium. KBC has been ranked as the best bank in Belgium six times in a row and offers good customer support for expats and entrepreneurs. It offers free accounts, as well as premium accounts for just €3.25 a month.

ING

Dutch bank ING boasts some of the lowest monthly fees of any bank in Belgium, with fees as low as €1.90 and free offerings for people under 26. This bank has facilities for expats and many resources are readily available in English. ING also provides services such as liability insurance and blocked rental guarantee accounts.

BNP Paribas Fortis

As the largest bank in Belgium by total assets, French bank BNP Paribas Fortis is also a safe option for expats anywhere in Belgium. BNP offers several free accounts designed for young people and a convenient mobile banking app.

How do I open a bank account?

In recent years, it has become increasingly easy to open a bank account in Belgium, with major banks now offering fully online registration. Some banks also offer expat services allowing incoming workers to open an account before the issuance of their residency card or arrival in the country.

Credit: Belga

Typically, expats can book an appointment online or over the phone to open an account at their local bank branch. Many banks offer specialist customer service in English and banking professionals should advise you on which documents to bring with you.

What documents do I need?

Exact rules will very from bank to bank, but in general expats will be asked to provide:

- Proof of ID. Banks will typically ask for a Belgian or EU ID card or passport. Non-EU expats may also be asked to show their visa.

- Proof of residency. In most cases, banks will ask for expats to already be registered with their commune and have received their residency permit. In absence of the card, which can sometimes take several weeks to receive, banks will typically accept a temporary residence document (annex 15) issued by the local commune.

- Proof of address. Typically, banks will ask to see a valid rental agreement with a local Belgian address. In some cases, they may also accept a proof of address from an EU Member State.

- Proof of income or employment. If employed, banks will typically ask to see a valid work contract. If not in employment, or the dependent of someone working in Belgium, banks will accept other proof of funds. Those coming to Belgium to work as a freelancer should bring valid invoices proving economic activity.

- Forms. Banks will sometimes ask you to fill out forms – either on paper or digitally – ahead of the appointment.

Changing banks

There's nothing worse that getting stuck with a bank which is too expensive or inefficient. Fortunately, switching banks in Belgium is very easy. Simply open an account at a new bank, inform the new bank that you would like to use their switching service to import your accounts, and they should provide you with a document to fill out.

Credit: Belga

Once filled out, this document is returned to the new bank who will take care of communicating with your old bank, moving your direct debits and balances, and any other additional services. This typically takes just over a week.

If your card is lost or stolen, don't panic and call Card Stop at (+32) 078 170 170. Even late at night, this service can stop thieves running up a bill with your bank card. Cards can also usually be frozen via their apps or websites.

Declaring foreign bank accounts

Many expats are unaware that the National Bank of Belgium requires all tax-liable foreign nationals living in Belgium to declare bank accounts which they control outside of the country.

All Belgian residents holding foreign accounts must report these accounts directly to the Central Point of Contact for accounts and financial contracts (CPC) which can be accessed online here.

Related News

- Will your wage increase in January? And by how much?

- Still no transparency on distribution of ATMs in Belgium

- Cancelling direct debits: What to know to terminate payment plans

This includes all checking, savings, term deposit, and securities accounts with any foreign bank, exchange, credit, or savings institution. Online wallets such as PayPal do not need to be declared, unless they are business accounts.

Even with a bank account in Belgium and all income earned in the country going through a Belgian bank, failure to declare your bank accounts from back home can have serious consequences and may even result in tax evasion charges and an administrative fine of up to €1,250.

If the State learns of these accounts, foreign nationals may be accused of having acted "with fraudulent intent" and face audit for the previous seven to ten years of accounts. Tax returns often remind Belgian tax residents to include foreign and domestic account information to avoid committing fraud.