Despite efforts to increase them, ATMs and bank branches continue to be more difficult to find – especially in neighbourhoods where people rely on these services.

Belgium is a leading nation when it comes to digital payments. One of the symptoms of this trend is physical bank branches and cash machines disappearing at a rapid rate across Belgium, prompting recurring complaints about the difficulty of withdrawing money.

Last year, an agreement was found between the Federal Government, the Belgian financial sector federation, Febelfin, and the Batopin (Belgian ATM Optimization Initiative) network to ensure that some 4,000 ATMs will be distributed throughout the country by 2027 in a "more harmoniously than today". However, transparency about the methodology to determine how ATMs would be evenly distributed across the country is lacking.

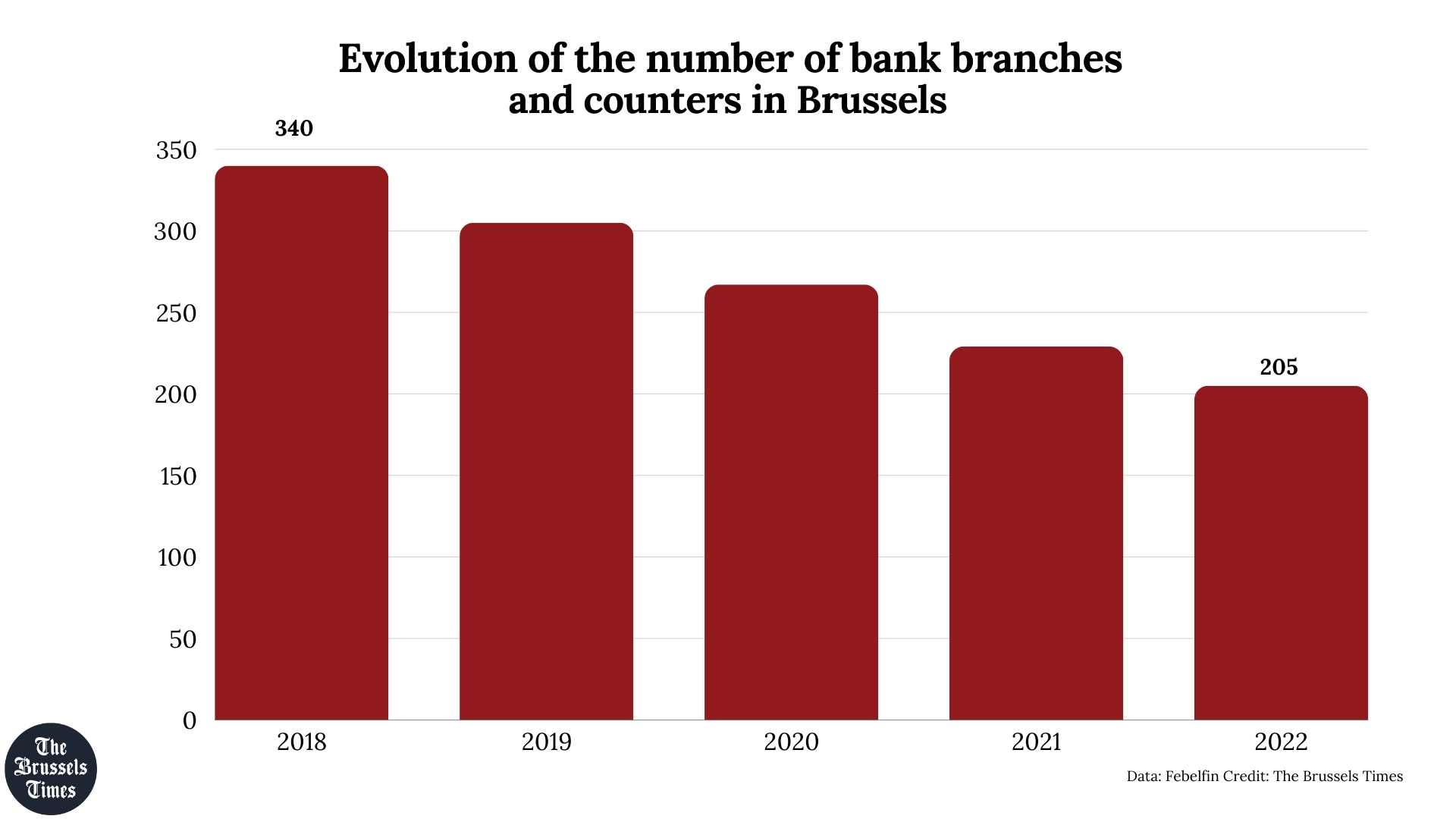

In the meantime, it is becoming increasingly difficult for residents to get out cash, especially in Brussels, figures requested by the Flemish socialist party Vooruit from Febelfin showed. Where there were 340 bank branches and counters in Brussels in 2018, this number declined to 205 by 2022, a 40% drop.

"The major banks in our country knocked off €7 billion in profits last year. There is enough financial room to provide branches and ATMs. Yet banks are reducing their services," said Bieke Comer, Anderlecht councillor for municipal finance and economic development.

While there are no regional figures on the number of ATMs, Febelfin's national data showed that the total number of ATMs evolved from 7,869 to 4,705 during that period. This amounts to at least two ATMs disappearing every day in Belgium since 2018, a trend that can also be felt in Brussels, where many residents have to travel far to get cash.

"In Anderlecht, vending machines are also disappearing," said Comer, "especially in residential neighbourhoods. Many people with small budgets live here, who she noted benefit from nearby, local services. "Using cash is a form of budget management for many people."

Low-income households are also less likely to have access to the Internet and their digital skills are more likely to be limited, further adding to their vulnerability in the digitalisation of banking services.

Jos Bertrand, a councillor in Watermael-Boitsfort, already submitted a motion for face-to-face service by banks a year ago which was supported by all political groups and voted on in January last year.

She highlighted that senior citizens experience more than others how their right to dispose of their funds is being undermined by the banks, as they are more likely to use cash. This is not only the case through branch closures but also through discriminatory charges for physical services.

"Banks must be there for all their customers: an accessible service in every neighbourhood, personal assistance and guidance with banking services for all customers, regardless of their income," said Bertrand.

Comer stressed that digital services are necessary but that they should not replace all physical offices and vending machines.