As many expats will agree, taxes in Belgium can be a headache. But once the correct amount has been paid (a sizeable chunk of your salary), calculating where that money goes is even more complicated, owing to the country’s overlapping authorities and broad distribution of funds.

Belgium’s multi-layered system of governance means that taxpayer money and social contributions are funnelled into diverse sectors, in theory leading to equitable spending across the population. But plans for government inevitably face real challenges, from emergencies to pandemics, embezzlement to corruption, issues with funding can prompt calls for greater transparency and reform.

Credit: SPF Finances

Pensions

Unsurprisingly given Belgium’s ageing population (the average national age rose to nearly 42 years old in 2021), the cost of state pensions weighs heavily on public finances.

This is especially true in Flanders, with the share of the population aged over 65 going from 17% in 2000 to 21% in 2023. At the same time, the portion of under-18s fell from 21% in 2000 to just 19% in 2023. In terms of tax, the burden of caring for the elderly sits increasingly on the shoulders of the younger workforce.

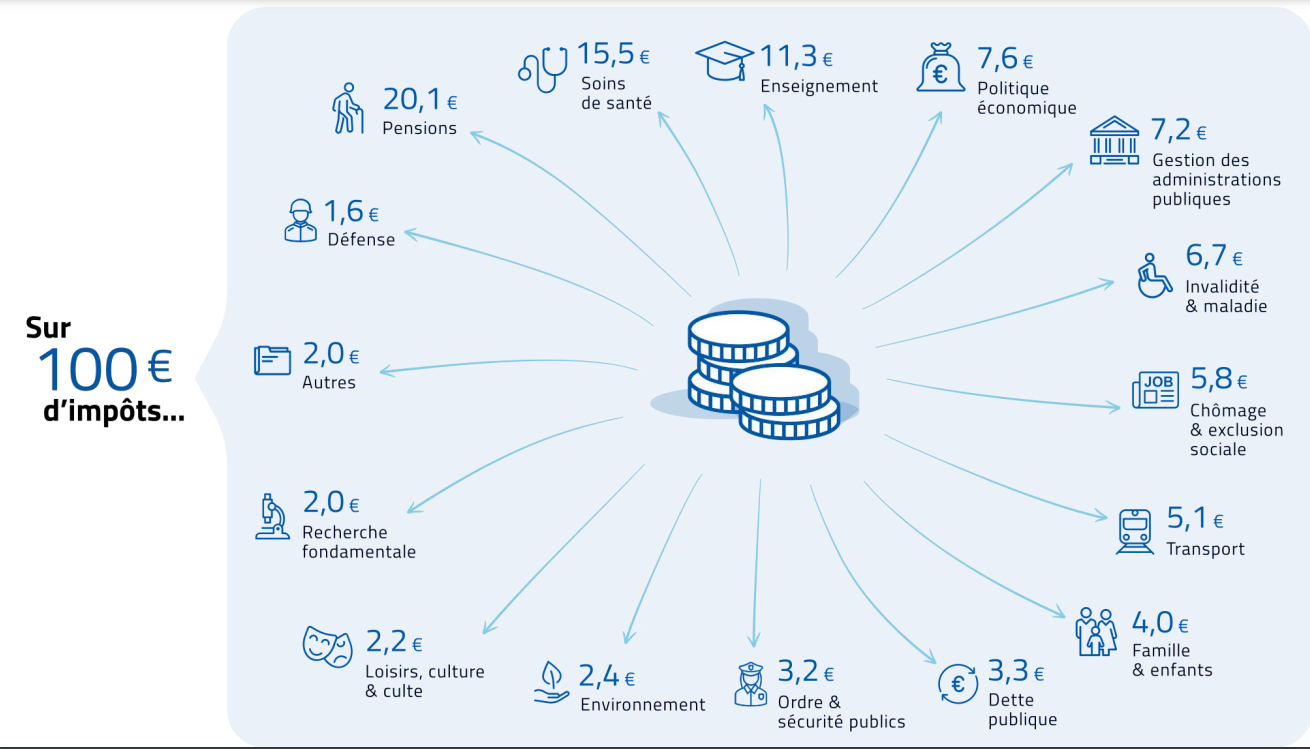

The weight of national pensions seems increasingly unsustainable given the ageing population. According to the Ministry of Finance, national pensions cost €55.9 billion in 2023 – equivalent to €20.10 of every €100 of taxes paid by the average person working in Belgium. This makes pensions the biggest source of State expenditure (just over 20%).

An old man outside a care home in Borsbeek. Credit: Belga/ Kristof Van Accom

Pension reform is a hot topic that pits fiscal sustainability against increasing life expectancy. Belgium’s elderly are now the most dependent on statutory pensions in the industrial world, according to statistics from the Organisation for Cooperation and Development (OECD). 86% of Belgian over-65s depend on public funds to survive.

Healthcare

Credit: Belga / Dirk Waem

€43.3 billion was spent on healthcare in 2023, largely in the form of subsidies in the form of social security contributions. Belgian residents with health insurance typically pay just a fraction of the true cost of essential medicines and treatments.

Health is the second largest destination for Belgian taxes: For every €100 collected in taxes, €15.50 goes towards healthcare. Generally, these high subsidies have paid off. The Belgian Heathcare Knowledge Centre describes the country's medical services as “affordable” and “high-quality”, though it notes that access to care is “often more restricted for the socio-economically disadvantaged groups.”

The sector has faced several major challenges in recent years, most notably the major strain on resources that came with the COVID-19 pandemic. This highlighted the need for more healthcare workers and better infrastructure. Occasional scandals related to the misuse of healthcare funding inefficiencies have prompted calls for better oversight and allocation of resources.

Education

With €31.6 billion invested in education, Belgium invests in multilingual education through its semi-independent regions.

Education is the responsibility of each language community of the country: francophone education is managed by the Wallonia-Brussels Federation (FWB) whilst the Flemish Community is overseen by the Flemish Parliament.

33% of all public funds in Belgium (€91.3 billion) are allocated to the budgets of Belgium’s regions and linguistic communities. A further €34.5 billion is allocated directly to municipalities and communes.

Credit: Belga/ Laurie Dieffembacq

However, a decline in academic performance across the country has led to heavy criticism of current regional education policy. Students from both French and Dutch-speaking regions performed poorly in 2022, spurring calls for reforms and investment in the field.

Educational infrastructure, especially in French-speaking regions, has been a point of contention. Nearly half of all French-speaking schools are in disrepair. Several hundred schools are still in use despite recommendations for their demolition. In 2023, Flanders earmarked €20 million for the modernisation of 78 schools across the region.

Government

With €20.1 billion directed towards government administration, Belgium invests in the machinery that keeps the public sector running. However, the structures of governance have not been immune to scandal, with officials implicated in the mismanagement of funds.

Several high-profile cases have highlighted a distinct lack of transparency in spending on government administration. Renovations of Wallonia's parliament building, originally expected to cost €10 million, have spiralled to €46 million. 70% of the cost increase has still not been explained by officials.

Credit: Belga / Bruno Fahy

Personnel costs from Belgium’s bloated public administration also weigh heavily on taxpayer funds. Growing public sector salaries, defined by Belgium’s unique wage indexation system, increase pressure on public finances. Between 2020 and 2023, the Federal Government spent an extra €125 million on external consultants.

In total, €7.20 of every €100 tax revenue goes towards government administration. This is more than double the amount allocated to policing or the environment.

Unemployment

Unemployment and social exclusion in Belgium are addressed with €16.1 billion of public funds. Unemployment figures vary between the more affluent Dutch-speaking north and poorer French-speaking south.

Unemployment in Flanders sits at 3.3%, compared to 8.2% in Wallonia and 10.7% in Brussels as of 2023. Regional governments, through regional unemployment and social services offices (CPAS), offer disadvantaged residents and jobseekers social security benefits. According to the latest statistics from 2021, CPAS spent around €1.39 billion in Brussels, of which 57% went towards social aid for local residents.

During the Covid-19 pandemic, unemployment payments weighed more heavily on State finances as a result of income support for furloughed and laid-off workers.

Public Debt

Tackling Belgium’s burgeoning public debt has become one of the top priorities for the Federal Government, which has been reprimanded on multiple occasions by the European Commission for its “irresponsible” level of public spending, funded in large part by borrowing.

With an allocation of €9.3 billion, €3.30 of every €100 of taxpayer money goes towards making payments towards foreign creditors. If Belgium is to maintain a healthy economy, this sum will likely increase.

The country's debt-to-GDP ratio is a point of concern, with implications the country's economic health. Without a change Belgium’s fiscal policy, public debt could rise from 105% in 2023 to an eyebrow-raising 117% by 2029, according to calculations from Eric Dor, Director of Economic Studies at the IESEG School of Management.

Belgium’s high levels of public debt may necessitate a reduction in public debt of 1.5% of gross domestic product (GDP) by 2031 in order to stay within EU budgetary rules. This would either be done through a decrease in government spending (austerity), or higher taxes on Belgian residents and companies.

Defence

Credit: Belga

Not traditionally known as military power, defence spending has become an increasingly hot topic in light of Russia’s invasion of Ukraine and growing geopolitical tensions.

In 2023, Belgium allocated €4.4 billion (1.6%) of its tax revenues, translating to just 1.1% of GDP or the second lowest spender in the NATO alliance. Defence is currently the smallest envelope in Belgium’s budget, eclipsed even by miscellaneous expenses. For every €100 taxes paid by citizens, just €1.60 went to supporting the armed forces.

Related News

- Expat Welcome Desk: The one-stop shop for expats looking to understand Belgium

- Belgian economy set to worsen in 2024, study finds

- Balancing Belgium's budget: Ministers on mission to finalise tax proposals

International commitments will soon force Belgium to rapidly expand its allocations in this regard. Belgium has pledged to reach 2% of GDP spending on defence by 2035, in line with its commitments to NATO. This is still a long way off, but the government is already ramping up investments into the army and the military sector.

This increasing budget has been met with sharp criticism, notably from the Belgian Greens, who criticised the plans against the backdrop of a difficult socio-economic situation for Belgium citizens. Belgian Prime Minister Alexander De Croo has previously commented that a cut to social spending would be “logical” in order to fund this increased defence budget.