Investing effectively is much simpler than what the financial industry wants you to believe. In this guide I share the full process of how to invest in ETFs in Belgium in 2025.

I also include a concrete example of a popular optimised portfolio for illustration. The example is highlighted in italic throughout the guide.

1. What is an ETF?

ETF stands for Exchange-Traded Fund. It’s a fund traded on the stock exchange.

So it’s a basket of investments, like stocks and bonds, that you can buy in just a few clicks via a brokerage account.

Instead of picking individual companies (and then stressing and hoping for the best,) you buy a fund that tracks an index.

Example: the MSCI All Country World Index contains over 2,500 large and mid cap companies across Developed Markets and Emerging Markets countries.

So instead of spending all day doing researching, analysing financial reports, tracking metrics and performances, or trusting some self-proclaimed forecasting guru, you buy an entire market, and simply get the returns of the market.

And as we know from countless reports and over 50 years of academic research, investing in index funds on average delivers higher value to investors than active investing.

2. Why invest in ETFs (investors in Belgium)

To put it simply, investing in index ETFs leads to better performance while paying less in fees, paying less in taxes than with bank funds for example, and spending much less time compared to more active strategies.

So, when done right you get better investment returns, save more money and save a ton of time.

This is because:

2.1 Index ETFs perform better than active strategies

For the past 50 years, academics have known that actively managed funds underperform their index and an equivalent portfolio of index funds. This has been proven again and again in tons of academic papers, as well in regular industry reports such as the Morningstar Active vs Passive Barometer, the SPIVA scorecard and many others.

On average, over periods of 10 to 20 years, actively managed funds underperform an equivalent portfolio of index ETFs more than 90% of the time. So why pay expensive investment managers and banks for them to give you a 90% chance of underperforming?

You’re the one investing your money and taking risks. Yet, they’re the ones getting paid no matter what the market does. That’s just unfair.

Investing in index ETFs is a no-brainer if you want to get the returns you deserve.

2.2 Index ETFs are generally much cheaper

Index ETFs are generally much cheaper than investment funds offered by banks. A typical bank fund in Belgium costs 2.1% entry fees + 1.4% ongoing management fees (based on 2024 FSMA report). There is also usually a 1.32% sale tax at the end.

In comparison, a good ETF will have a transaction tax of 0.12% and an average management fee of 0.14%. This is 10 times cheaper than banks! And it compounds year after year.

2.3 Index ETFs can be very tax efficient

Belgium is known for being a country with very high taxes.

But when it comes to index investing, this is the complete opposite, we’re one of the countries with the lowest investment taxes.

There is no capital gain tax until the end of 2025.

From 2026 there will be a 10% tax on capital gains, which is still one of the lowest in Europe. By comparison, the capital gain tax in France is 34%, 33% in the Netherlands and 26% in Germany.

This 10% tax applies only when you sell and the first 10,000 EUR of capital gains will be exempt. So the impact on small and medium portfolios will be minimal. I will write a separate article dedicated to this tax soon as there is a lot to discuss.

On top of that, most stock market investments in Belgium are subject to a transaction tax of 1.32% and dividend tax of 30%.

But if you choose carefully (I explain how to below), you can invest in ETFs that reinvest the dividends (so you don’t have to pay tax on them) and for which the transaction tax is only 0.12%. This is 11 times less!

2.4 Index investing can be done in less than 1 minute per month

With the development of automatic investment features by Belgian brokers such as Saxo and Bolero, investing can be fully automated.

Once you’ve developed your Personal Investment Plan, you can set it up on autopilot.

I still recommend you take a minute each month to make sure things are going according to your plan and the money actually gets invested, but otherwise there is nothing to do (assuming the automatic investing system also handles all Belgian taxes).

3. How to select an ETF

The choice of ETF depends on some of your personal preferences and needs (such as whether you want full global exposure, or just developed markets, whether you want to invest according to certain ethical principles or not, etc.)

You also need to develop your asset allocation and include some form of fixed income in your portfolio. Later in this article I explain how to build your portfolio.

But overall, my recommendation for most people is to select a stock index ETF that:

- Is managed passively (tracking a global index)

- Is globally diversified (i.e. tracks an index like the MSCI World or equivalent)

- Has a low total expense ratio and low tracking difference

- Is already well established (> 100 mil EUR)

- Reinvests the dividends automatically

- Is domiciled in Ireland

- Is registered in a country of the European Economic Area but not in Belgium

The last 3 criteria is to minimize Belgian taxes.

Example: if we want to invest in an ETF tracking the MSCI All Country World Index, we could select SPDR MSCI All Country World UCITS ETF. This ETF satisfies all the criteria above. Its ISIN number (unique identification number) is IE00B44Z5B48. The ETF is available in Frankfurt (Deutsche Börse) with the ticker symbol SPYY, and on Euronext Paris with the ticker symbol ACWE.

4. How to buy an ETF in Belgium?

In countries like the US, you can open an investment account directly with fund providers like Vanguard. In Belgium, we invest in ETFs via low-cost online brokers, such as Bolero, Saxo, Re=Bel, Keytrade, MeDirect. These are Belgian brokers that handle all Belgian taxes for you.

There are also non-Belgian brokers that handle some of the Belgian taxes or none at all.

Investing through a broker is not too complicated. While you need some knowledge, it’s essentially similar to buying sunglasses on amazon: you open an account, select the product you want, check the brand, select the supplier, check the transaction/delivery fees and then confirm the order.

The difference is that with ETF investing, you’re not spending money on an item to be used but you’re buying a small piece of the economy, and in doing so you’re building financial security and freedom.

Example: if you’re an investor in Belgium, you can open an account with both Bolero and Saxo for example, try them out and then go with the one you like most. They’re both solid choices as they handle all Belgian taxes and have low-cost investment options.

5. How much should I invest in ETFs?

In short, invest as much money as you can that is not in your emergency fund and that you don’t need in the short term.

You can start from €5 or 10, especially with brokers that offer fractional shares, but it does make more sense to invest with larger sums. A good starting point is 100 € per month, but the more you can increase your contributions, the more you’ll benefit from the compounded growth of the stock market in the long term.

At some point in my personal investing journey, when I was earning a lot and spending little, I was investing 75% of my income. I invested everything I was saving beyond my emergency fund. That is what propelled me into financial independence at 33.

So, invest what you can, based on your possibilities. Make your savings work for you effectively rather than keeping it on a savings account or in expensive bank funds.

Example: most people in Belgium are able to save 300 € or more per month. So let’s take the example of investing 300 € per month into ETFs.

6. How often should I invest in ETFs?

As soon as you can. As the markets go up in the long run on average, investing earlier is generally a good idea. But you don’t want to invest too often either to minimise transaction fees.

If you have a lumpsum, you can invest it all at once, or split it over several months to smoothen your entry into the stock market (having the right asset allocation is also important).

Then continue investing monthly, or quarterly if you save small monthly sums and that the transaction fees are on the high side.

This tool can help you decide how often to invest: https://investcalc.github.io/

Investing regularly is also called Dollar/Euro Cost Averaging (DCA) where you buy for a similar amount of money each month whatever the price of the ETFs are. When they’re expensive you naturally buy fewer shares, and when they’re cheap you buy more of them. It’s a simple strategy that allows you to benefit from the ups and down of the market and you can invest without worrying about what the markets are doing.

If you invest monthly, consider setting up an automatic investment plan, offered by some brokers, where you can schedule future recurring investments.

7. How to build your portfolio?

When you start investing, you don’t just buy the first ETF that people online recommend.

It’s also important to understand your needs and develop an investing strategy that is suited to your needs.

It might sound complicated, but it’s a lot less complicated than the industry wants you to believe.

The main decision you need to make is how much equity and how much fixed income you’re going to have in your portfolio. This is called your asset allocation.

Your asset allocation will determine the outcome of your investing far more than the specific broker or ETF you select, as it determines the level of risk/volatility and potential performance of your portfolio, as well as, and probably more importantly, your ability to stay the course.

Too much equity and you might panic when markets go down. Too much fixed income and you might be giving up on too much potential gains.

So the percentage of stocks (equity) and bonds (fixed income) in your portfolio will play a big role.

A good starting point for many people is 70% stocks and 30% bonds in the accumulation phase, and 50% stock and 50% bonds in the transition and withdrawal phase.

A simple way of building a portfolio that matches your asset allocation is to invest in 2 ETFs in the right proportions: 1 global stock index ETF and one high quality bond index ETF.

Once you’ve decided on your asset allocation and selected your broker and 2 ETFs, you can include them in your Personal Investment Plan (PIP). Your PIP is your guiding document where you summarize your strategy and all the important information about your investing.

Example: in addition to the SPDR MSCI All Country World UCITS ETF described earlier, we can add a high quality short term EUR government bond ETF for example: Amundi Prime Euro Government Bonds 0-1Y UCITS ETF. Its ISIN number is LU2233156582. It’s available in Frankfurt (Deutsche Börse) with the ticker symbol PRAB.

An example of simple optimized ETF portfolio for investors in Belgium would then be 70% SPDR MSCI All Country World UCITS ETF + 30% Amundi Prime Euro Government Bonds 0-1Y UCITS ETF

8. Investing in practice

Once you’ve decided on your asset allocation (as in step 7), selected your ETF (as in step 3), and opened a brokerage account (as in step 4), you’re ready to invest.

You fund your broker account by bank transfer and once the money is there you can make your first transaction.

To find your ETF on the brokerage account, I recommend you search for its ISIN number, which you can find on its webpage or on its factsheet. Using the ISIN number ensures you’re buying the correct ETF.

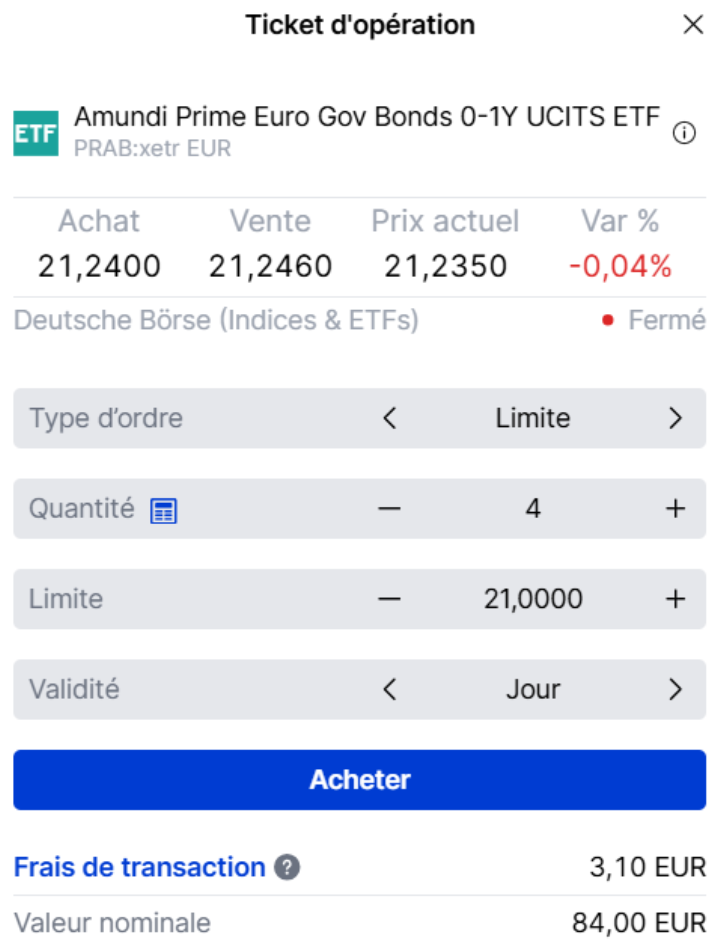

You then select the amount you want to invest and you select the type of order. You can do a market order, or a limit order with a price a euro or two below the ETF price. Both options are fine.

Before you confirm, you will see a summary of the transaction, including a breakdown of costs and taxes. If everything is good, you confirm the transaction.

It’s better to do this during the stock market opening hours so that the transaction goes through right away.

Example: For our example of an investor investing 300 EUR per month into 2 ETFs, 70% stock index ETF and 30% bond index ETF. For the bond part of the portfolio we invest for up to 90 EUR (30% of 300 EUR) of Amundi Prime Euro Government Bonds 0-1Y UCITS ETF. ONe share of this ETF is worth 21.235 EUR as of today. With 90 EUR, we can buy 4 of them. Here is what that would look like with a limit order on Saxo:

After that you do the same for the stock index ETF and that’s it!

Congrats! You’re an index investor!

9. How to Build Wealth on Autopilot

Once you’ve defined your Personal Investment Plan, implemented it and automated it, you can focus back on living your life to the fullest, knowing that you have a solid optimised system to build wealth.

You can also spend more time improving the value you provide to the world so that you can earn more, save more, invest more and build financial security and freedom faster.

If you’re interested in joining a community of people who are on this path, check out the FIRE Belgium website, podcast and Facebook group!

This article is for informational purposes only. Investing involves risk, including the possible loss of capital. Readers are encouraged to do their own research before making any investment decisions.