As all other countries, Belgium’s economy was severely hit by the COVID-19 outbreak in 2020. Since then, the vaccination roll-out has taken up speed and there is now room for optimism. According to the European Commission’s recent Spring 2021 economic forecast, all EU member states should see their economies return to pre-crisis levels by the end of 2022.

In an interview with The Brussels Times, economy professor André Decoster at the Catholic University of Leuven (KUL) gives his view about the economic key indicators in the Commission’s forecast, compares Belgium with its neighbouring countries and explains the macroeconomic challenges ahead in the Belgian economy.

Question: What should be the most urgent issues on Belgium’s economic agenda after the health and economic crises during COVID-19?

Answer: The most urgent issue is long-term fiscal sustainability – neither the general government budget deficit, nor the high debt level, now at 115% of GDP. There is a problem in Belgium with long-term fiscal sustainability given the projected expenditures on pensions, the projected expenditures on health care, and given the choices made at the revenue side by the previous government.

Economists have indicators to express the imbalance between expenditures and revenues over the very long horizon. Before the coronavirus crisis, these indicators showed the primary structural balance needs to be improved by about 4% of GDP to restore fiscal sustainability. It’s important to stress that it’s not the pandemic which has triggered the fiscal sustainability challenges.

Restoring fiscal sustainability in the long term will consist of both measures to manage expenditures better and to reform the revenue side in such a way that social support for contributions and/or taxes is enhanced. At the expenditure side, the current government has promised to lay down a plan to control the surging pension expenditures.

First drafts of this plan have been promised for September this year. There is no indication yet whether this will be realistic. Previous efforts to rebuild the publicly funded part of the pension system have always failed.

At the revenue side there are two challenges: the current fiscal system, mainly personal income tax and corporate income tax, is perceived as unfair, too complex, and with a too high average tax rate.

The second less known challenge is the erosion of financing sources for social security. The two main sources now are social security contributions on labour income and government subsidies. Social security contributions have been reduced to lower labour costs, but this erodes the financial resources for the system.

To sum up: What is needed is a pension reform, a fundamental tax reform, and a long-term vision on how to finance social security.

Q: Compared with other EU member states, how was the Belgian economy affected by the crisis during 2020 in terms of economic growth, unemployment, budget deficit and debt-to-GDP ratio? How do you foresee the economic recovery during 2021 and 2022 in terms of these key figures?

A: There are two sources for the macro-economic forecasts. One is the forecast of the Belgian Federal Planning Bureau (FPB) which was produced in February 2021. It runs to 2026 and was submitted to the European Commission. The other one is the Commission’s 2021 Spring Economic Forecast from May. Both forecasts are very much the same but the Commission’s forecast includes comparable figures for neighbouring countries.

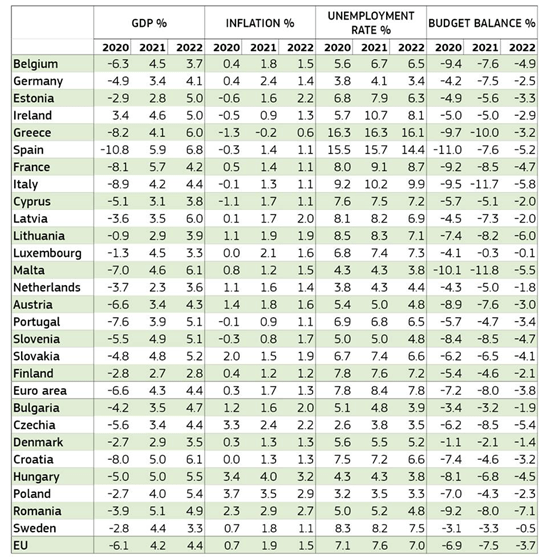

According to the European Commission’s Spring forecast, Belgium’s shock decline in the GDP in 2020 by -6.3% was in line with the EU (-6.1%) and the euro area (-6.6) average. The forecast for this year is +4.5%, again about equal to the EU and euro zone averages. The 2020 drop in GDP is larger than for Germany and the Netherlands, but smaller than for France.

Source: European Commission's 2021 Spring Economic Forecast

However, the forecasted rebound for Netherlands and Germany is also smaller than the forecasted rebound for Belgium and France. The overall growth of Belgium and France by 2022 is only slightly below that of Netherlands and Germany.

Unemployment is forecasted to increase by +0.9 percentage point in 2021 and drop by -0.2 percentage points in 2022. The unemployment figures illustrate again that the Belgian macro-economic performance more closely tracks France than the Netherlands and Germany.

To sum up: There is no real divergence between Belgium and neighbouring countries. The real divergence is between EU and US/China; and internally in EU (and with UK).

Q: Belgium has (or had in the past) one of the highest tax burdens in the OECD with high marginal taxes and a focus on labour taxes and social charges. Is this going to be changed in the future with the shifts in taxation on consumption and green taxes to reduce greenhouse emissions?

A: The current government has announced a “fundamental tax reform” to tackle the perceived problems (labour taxes too high; perceived inequality) and the less perceived ones (inefficiencies in the tax system). The Minister of Finance has commissioned a report/advice, to be written by a group of experts/academics. The group has not yet been installed, but might be announced shortly.

The main purpose is to decrease taxes on labour income and not necessarily to decrease the overall tax revenue as a percentage of GDP. Some voices in the public debate indeed support a shift to VAT/excise taxes on goods and services. Except for environmental reasons, I do not support this view. Like many other economists, I think that shift from labour taxes to VAT only has second order effects.

If one really wants to shift away from labour, there is only on other revenue source and that is the production factor capital. Even without shifting the balance between labour and capital, I think that there are substantial gains to be made by reforming capital income taxes: making them more neutral across the different forms of investments, moving away from transaction taxes, and taxing capital gains.

As for the personal income tax, the year-long recommendation of broadening the tax base by removing all kind of tax deductions could easily lead to a lowering of the average rate.

Q: Many countries under-financed their health care systems before the crisis and today there are demands to fill the gaps. Do you foresee any significant increases to the health budget as a result of the crisis?

A: The COVID-19 crisis was indeed a stress test for the Belgian health care system. But most people agree that it performed well. If there were any problems in the first wave, it had to do with the nursing homes.

However, there are long-term challenges in matching the increase in health care expenditures with additional revenues. The direct effect I observe now is that the year-long call, or political struggle, to cap that increase, is now silenced somewhat. But this only reconfirms one of the challenges already mentioned: develop a feasible and credible plan to fund increasing expenditures in social security; especially in health care if this increase is driven by technological developments.

Q: One of the best-known EU measures to help the member states to weather the economic crisis during the pandemic was the “SURE” instrument for loans to fund national short-term work schemes so that companies can keep their employees with income support from the state for the hours not worked during the crisis. How did it work out in Belgium? How many of the workers are expected to return to their previous jobs?

A: Belgium was granted €8.2 billion of financial support under SURE from which €6.2 billion has already been disbursed. The expenditures on unemployment benefits more than doubled from €4.8 billion in 2019 to €12.7 billion in 2020. This increase of €7.9 billion is mainly due to temporary support mechanisms both for employees and self-employed individuals.

In the course of 2020, one in three employees or 1.4 million employees became temporary unemployed due to COVID-19 in 2020. At the peak in the first wave – March/April 2020 - 1.2 million were temporary unemployed, this fell back to about 300,000 in January 2021. They received a benefit of 70% of their earnings during the period they were unable to work, which was higher than the pre-Covid-19 replacement rate of 65%. Access to the system was also eased.

Self-employed individuals who were temporarily forced to stop their activity received a lump sum benefit up to €1,600 per month. On top of that federal “income compensation measure”, there was also a variety of support measures by the three regional governments, as much as possible focused on the most heavily affected sectors (hotels-restaurants-cafés; cultural events, etc). This regional support varied considerably across the regions.

The cost of the two federal measures amounted to €4 billion and €3.4 billion respectively in 2020. The increase in expenditures of € 7.9 billion mentioned above is therefore mainly to be attributed to these two measures. The two measures have been continued in 2021, albeit to a more limited number of people, and thus it seems that the total expenditure on income support mechanisms will exceed the €8.2 billion of financial support granted under SURE.

Answering the question about how many workers are expected to return to their previous jobs is difficult. The hope of a “temporary” support mechanism is that all employees, after a temporary interruption, will return to their job and restart their activity.

The decline of temporary unemployed from the peak of 1.2 million at the beginning of the first wave to about 300,000 in beginning of January 2021 indeed suggests that a large part of the temporary unemployed have resumed their original activity. But this in no way means that there might not be a surge in unemployment in the next months, driven by the dynamics in the heavily affected sectors once the government support mechanisms are withdrawn.

M. Apelblat

The Brussels Times