After slumping for weeks, the euro and the US dollar reached parity on Tuesday for the first time since the euro's circulation in 2002 and plunged below the one-dollar mark, trading for 0.9998 dollars, by Wednesday.

This signals that it is possible the European economy is heading for a deep recession as a result of Russia's invasion of Ukraine and rising fears that it might turn off gas supplies to Europe.

However, according to Eric Dor, Director of Economic Studies at the IESEG School of Management, this news is the result of a long depreciation that has just been accelerated by recent events.

A turbulent fall

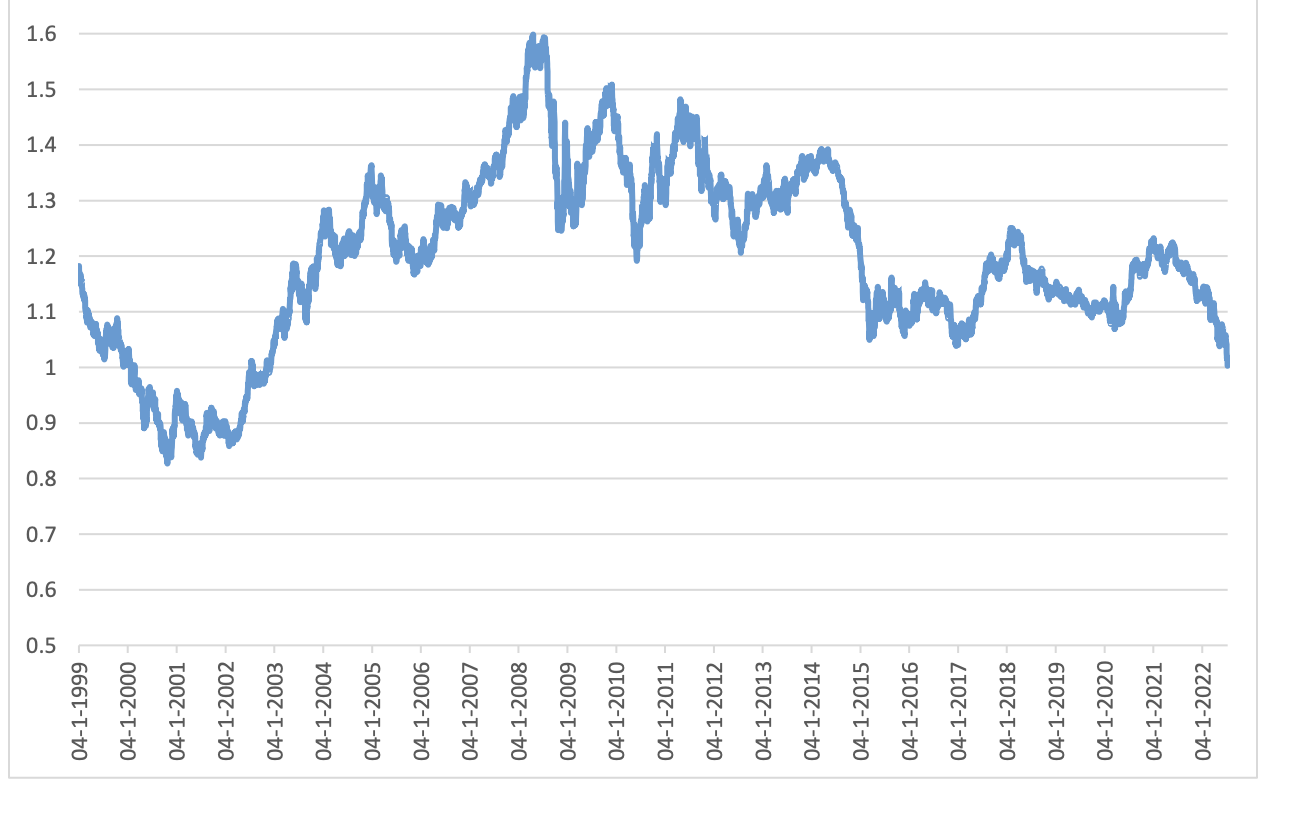

Since the start of January 2021, a recent high for the euro, its value depreciated by 19%. Since the currency's all-time high on 2 April 2008 during the financial crisis, its value decreased by 37%.

This depreciation partly reflects the strong appreciation of the dollar, according to Dor. "The euro is actually holding up better in terms of most other currencies," he wrote in a report shared with The Brussels Times.

Taking this into account, the drop in the value of the effective exchange rate of the euro has been limited to 8% since the start of last year and 17.5% since 22 April 2008.

A visualisation of the decreasing value of the euro since 2008. Credit: IESEG, data from Reuters

The fact that the value of the euro compared to the dollar has decreased is the result of a combination of various causes, Dor explained.

Why is the dollar outperforming the euro?

Both currencies fall under different monetary policies, which vary particularly when it comes to the interest rate.

"The Fed (Federal Reserve – the US' central banking system) cut rates less than the European Central Bank (ECB) and avoided negative rates. But then the Fed started tightening monetary policy and increasing rates well before the ECB, which will only start to raise its key rates on 21 July," Dor said.

Related News

- Euro reaches parity with dollar for the first time since 2002

- As interest rates rise, property market cools and young people buy

Meanwhile, the ECB has suggested it will raise interest rates by 25 basis points, with a second increase planned in September. The Fed raised its key rates by 0.25% on 17 March, by 0.5% on 5 May and by 0.75% on 16 June to curb inflation.

Dor explained that, while the Fed has a clear determination to raise rates as much as necessary, internal discussions between the members of the ECB's Governing Council about how to tighten its monetary policy are slowing down its response to the rising inflation.

"Once again, this divergence between the ECB and the Fed argues in favour of the dollar," he said.

Other internal disputes weakening trust

Other disagreements among ECB Governing Council members, such as about the need to introduce a new instrument to curb the fragmentation of the eurozone (the 19 EU Member States that have adopted the euro as their currency), for example through selective purchases of government bonds from highly indebted countries, are also contributing to the euro's weakness.

For outside markets, the possibilities for the ECB to control debt spreads, and thus maintain the integrity of the monetary union, remain uncertain. A new eurozone sovereign debt crisis, like the one that took place from 2009 until the mid to late 2010s, remains a possibility.

"This also meant the markets' mistrust of the euro is maintained," Dor pointed out.

Russia's role

The mistrust is further exacerbated by the issues faced by Germany, a major eurozone economy, of which the industrial sector is threatened by shortages of imported goods and by problems with Russian gas and oil supplies, resulting in its trade surplus in value collapsing and the entire eurozone being threatened by a recession.

"Overall, the eurozone's extreme dependence on energy imports from Russia makes its prospects very uncertain, compared to the self-sufficient United States. This leads the markets to prefer the dollar to the euro," Dor said.

Although there is a high probability of recession in both the EU and the US, the impact on the latter is likely to be less severe and shorter.

Temporary situation?

Taking into account the causes of the euro's depreciation against the dollar, this situation is likely to persist. "Unless an asymmetric shock affects the US by surprise, the fundamentals will remain in favour of the dollar and against it for a long time," Dor said.

This means that, for the time being, certain goods and services delivered by countries in the eurozone are worth less than those from the dollar zone. It also means that, for people buying from the dollar zone, goods produced in the eurozone are more attractive, as they will be cheaper.

"This could therefore stimulate exports from the eurozone countries to the dollar zone. As far as services are concerned, this could establish itself in tourism." However, not all countries export goods to the dollar zone in the same way; Germany for example will benefit more from this than Portugal.

Impact on inflation

Last month, inflation in Belgium neared 10%, the highest in four decades. According to Dor, the depreciation of the euro against the dollar will only add to this inflation, as this further affects the dollar prices of oil, food, metal and other raw materials, many of which are already in short supply, meaning they are more expensive.

"When these dollar prices are converted into euros, the increase is even greater because of the depreciation of our currency. European companies' costs in euros are rising sharply, and they will have to pass this on to consumers in their prices, meaning goods will become even more expensive," Dor concluded.