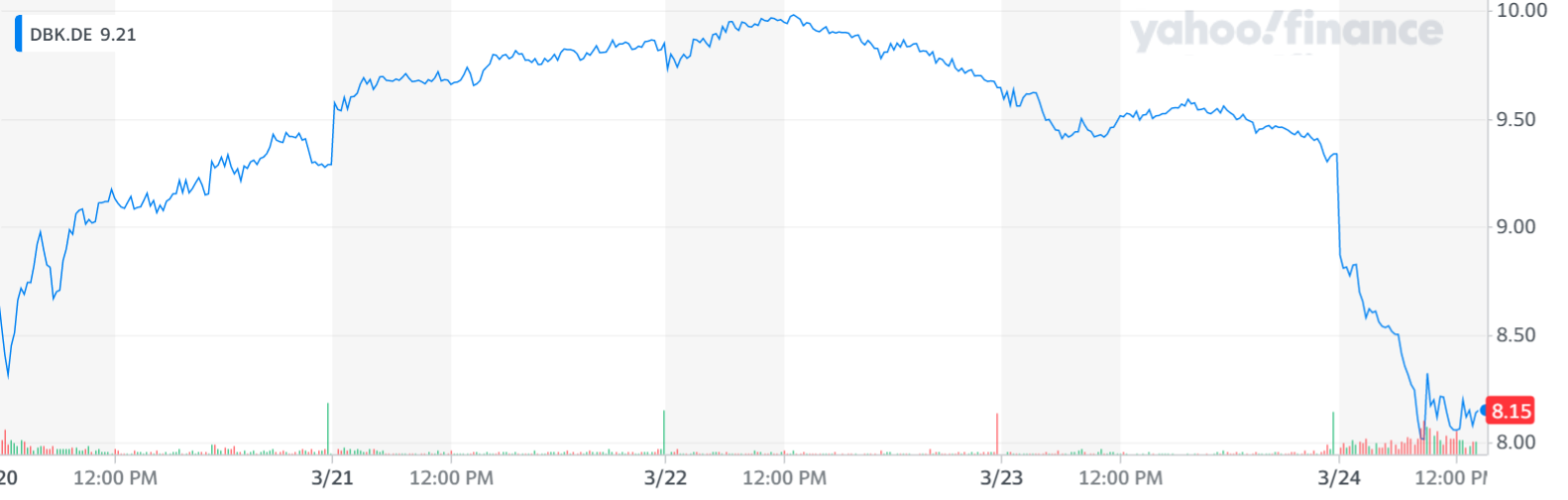

Shares of Germany’s largest bank, Deutsche Bank, have fallen for the third consecutive day as the ripple effect from troubles in the American banking sector continue to rock Europe. The German lender's shares have now lost more than a fifth of their value so far this month.

The emergency purchase of Credit Suisse by UBS at the start of the week has drastically shaken the confidence of investors in Europe’s major banks.

The share price of rival Commerzbank dropped 9% this morning and Credit Suisse, Société Générale, and UBS all fell by more than 7%. Barclays and BNP Paribas also slumped by over 6%.

Credit: Yahoo Finance

Most European stock markets dropped by around 2% this morning in fear of a fresh wave of financial difficulties for European banks. Shortly before lunchtime, the STOXX Europe 600 banking index was down 1.78%. At the time of writing, Deutsche Bank shares lost over 13.5% of their value, falling to €8.07 per share.

Declining financial confidence in Germany’s largest bank was sparked by a spill in credit default swaps on Thursday evening, bolstering concerns for the stability of the bank.

Credit default swaps are a type of insurance for the company’s bondholders against the bank’s default, leading to fears of a collapse. These credit swaps jumped up to 173 basis points on Thursday evening against 142 the day before.

Related News

- Wall Street flounders after the Fed's accommodating interest rate hike

- Markets hold their breath following Credit Suisse takeover

- 'No risk' to Belgian banks following week of turmoil, governor reassures

A ripple effect of fear and pessimism among investors after SVB’s collapse has only been aggravated by the U.S Federal Reserve’s (FED) ever-increasing monetary policy and the last-ditched rescue of Credit Suisse. Swiss authorities and central banks hoped that the speeding authorisation of Credit Suisse to its rival would help calm investors, but it appears that this has done little to reassure them.

Lender Deutsche Bank has traditionally been a profitable bank. It has posted 10 consecutive quarters of profits following significant restructuring in 2019. The bank was previously believed to have enough liquidity and capital to weather external shocks. Nevertheless, investors fear that Deutsche Bank could still be the next domino to tumble.