How energy is taxed will make or break the global shift towards a green economy. A number of countries have tweaked their taxation policies in recent days to better reflect the transition that is currently well underway.

Energy is now all about cost. Whether that is financial or societal, the be all and end all of the debate now ultimately comes down to the bottom line.

Political forces across Europe now know that their survival very much hinges on energy bills and reducing their impact on households.

Long-term, that means building more clean energy capacity and designing efficient payment structures around them. That is by far the most sustainable solution but it will take time, time which many governments and their short five-year cycles do not have.

How energy is taxed can provide short term relief and help lay the groundwork for longer-lasting policies. Many governments are now looking into how often outdated taxation systems can be rewritten to better reflect the 21st century.

In the Netherlands for example, the parliament recently voted to allow road fuel excise to increase. A small charge applied to each litre of petrol and diesel will be used to help pay for public transport ticket increases and make sure services remain operational.

Ultimately, this tax is about reducing demand for private road transport and bringing down emissions.

The Dutch have a strong track record of responding proactively to energy crises: the 1970s oil crisis prompted the government of the time to implement car-free days and encourage the use of bicycles, which are now synonymous with the country.

Private jets and conventional air travel will also be subject to new and increased taxes, in a bid to reduce the most polluting forms of transport.

Belgium’s government also agreed on a new budget after marathon talks, including new tax policies. The most notable of those is a reduction of VAT on electricity and an increase on fossil gas.

It means that houses predominantly powered by electricity will save money, while those still relying on gas will feel an increase. If the right support schemes do their job, it should trigger a wave of gas boiler and gas cooking switches to electricity.

Just like its Benelux neighbour, Belgium will also implement a flight tax on departing journeys of more than 500 kilometres.

Germany is also struggling with bills but it is mostly industries that the government is focusing its efforts on. A €3 billion euro electricity tax reduction scheme was only temporary at first but now it has been made permanent.

Unlike the Benelux though, Berlin has scrapped its plan to increase existing flight taxes.

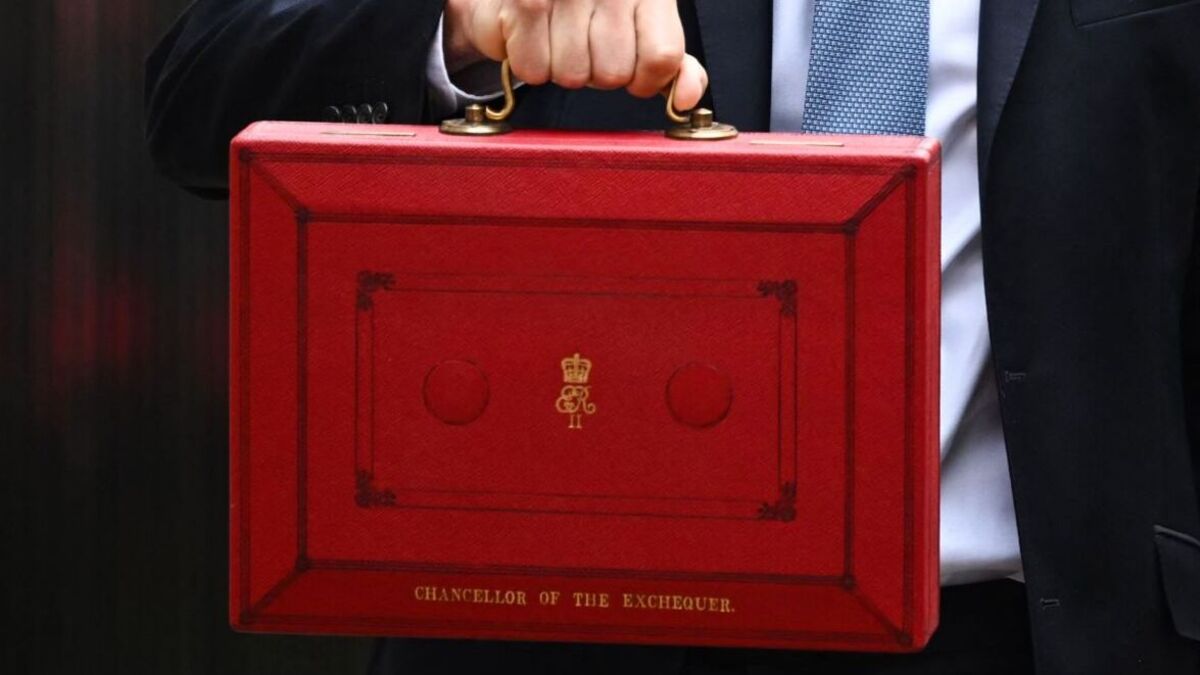

Across the Channel, the United Kingdom government’s new budget was released this week, heavily geared towards bringing energy bills down by £300 every year in order to fulfil the Labour party’s manifesto pledge.

Around half of that will be managed by shifting payments for renewable support schemes from energy bills to general taxation, as well as scrapping a separate initiative for energy efficiency upgrades.

The government is also planning a brand new tax on electric vehicles, which will be charged per mile driven as of 2028. Official estimates show that this will decrease demand for EVs but the government insists it is necessary.

That is because the amount of revenue generated from fuel duty will plummet as more motorists make the switch to all-electric. Fuel duty makes up a big part of the budget so EV owners will have to help pick up the slack.

How that charge will actually work and how motorists will report their mileage still needs to be worked out.

And finally, at European Union level, negotiators are still trying to agree on an update to the energy taxation directive, a set of rules that is now more than two decades old.

Taxation requires unanimous consent so all efforts so far to drag it into the modern age have failed. A fresh push by the Danish presidency of the EU Council has also come up short as there simply is no window in which to broker a deal between 27 countries.

The big hopes for the directive update are to amend the limits on fossil fuel taxation, reduce the tax on electricity and implement charges on aviation and maritime fuels, which are currently exempted.

But given the holdup, it looks likely that it will remain up to national governments to forge their own paths on taxation.

Want more updates and analysis of what is happening in the world of energy and climate? Interested in finding out more information about public tenders and consultations? Sign up to our Energy Rundown newsletter here!