The market share of the largest producers in the electricity and gas market within the European Union has decreased in most Member States since 2013, new statistics published by Eurostat, the EU’s statistics agency, revealed on Tuesday.

Market share shows how much of total energy production is accounted for by the largest company in the market. Large market shares typically indicate a natural monopoly or an oligopolistic market.

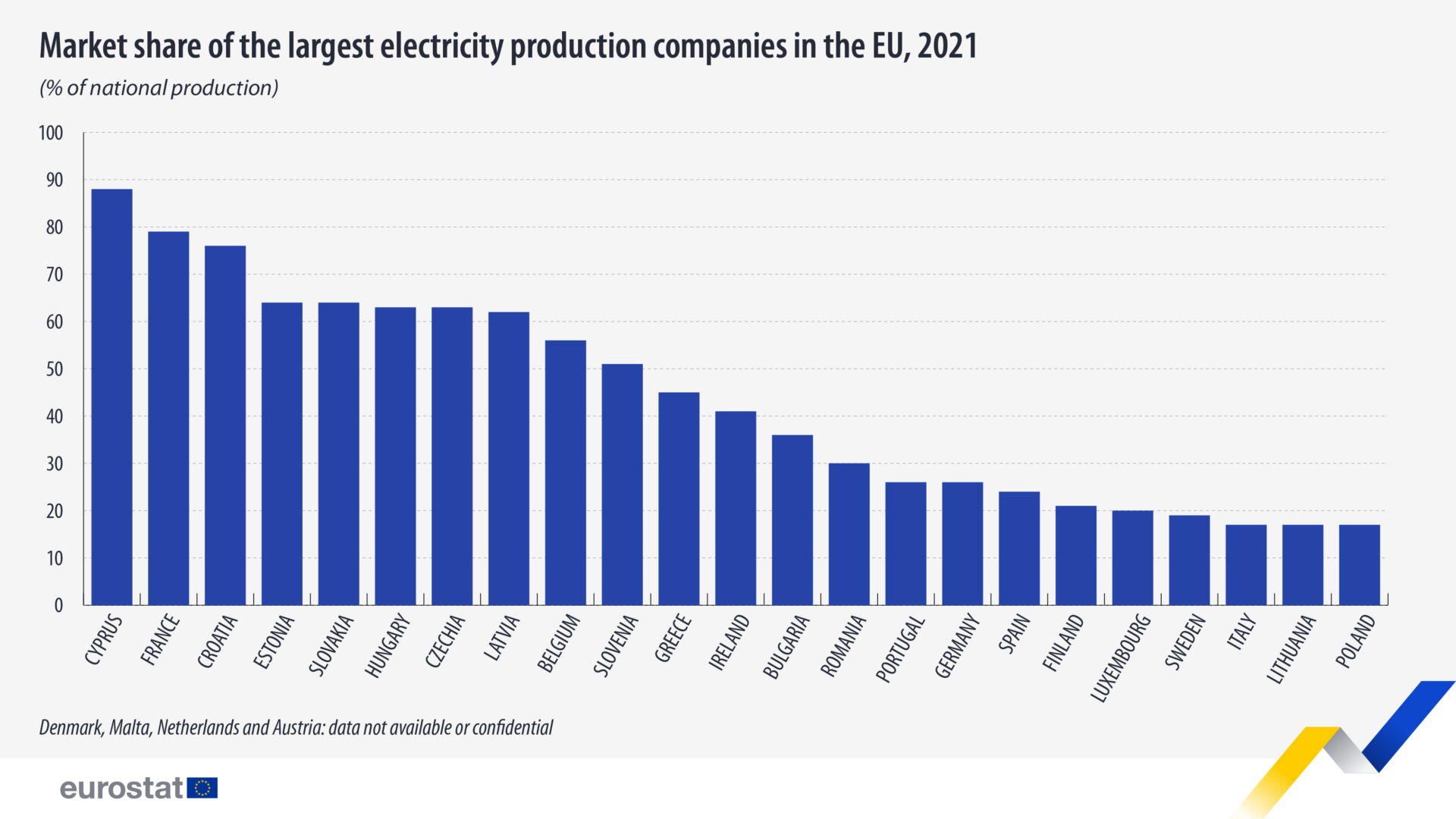

At the last count in 2021, the market share of the largest electricity producer in the individual states was highest in Cyprus (where one company held 88% of the market), France (79%), Croatia (76%), and Estonia (64%).

Credit: Eurostat

The market was most pluralistic in Poland, Lithuania, and Italy – where the largest provider accounted for just 17% of total market share.

The latest data reveals a decade-long decline in the market share of the largest electricity producers in most EU countries. This was most notable in Luxembourg, where the share of the largest provider dropped 20 percentage points. The only increases in market share were recorded in Hungary (+10 pp), Romania (+3 pp), and Spain (+2 pp).

Big players still dominate gas market

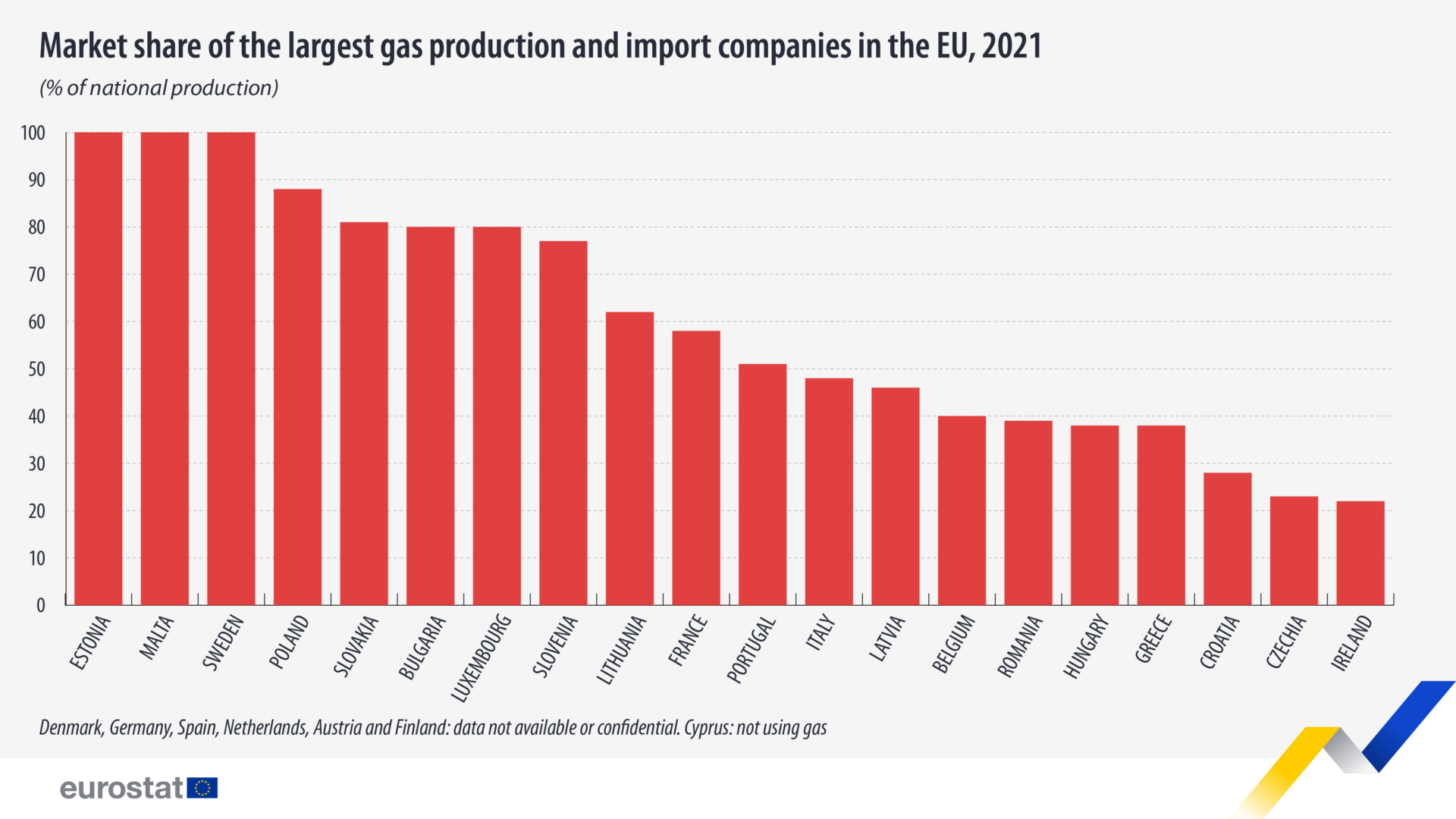

Though market share has dropped, the gas market is still dominated by a handful of major companies. Natural gas import and production companies tend to be strongly monopolistic. In Estonia, Malta, and Sweden, one company controls a 100% share of the market.

Countries with the largest monopolies tend to be those that produce little energy from natural gas. For example, in 2021, Sweden derived only 2.3% of its total energy needs from natural gas. Malta is an extremely small market and therefore one company is needed to cover demand.

Credit: Eurostat

The most pluralistic gas markets can be found in Ireland (22%) and Czechia (23%). From 2020 to 2021, the largest decrease in market share for the largest provider was reported in Croatia, which dropped by 45%, and in Czechia, which fell by 38%. The number of companies that import or produce natural gas in Czechia increased from five to six in Czechia, and from three to five in Croatia.

Related News

- Belgians overwhelmingly favour forcing energy companies to offer fixed-rate deals

- Electricity operator Elia’s profits leapt by 25% last year

In 2021, the market share of the largest natural gas import and production company decreased in 14 Member States, compared to 2013. In Greece, this fell by as much as 61 percentage points.

In 2021, the largest electricity producer in Belgium (Engie Electrabel) controlled a 56% share of the market – up 6 percentage points since 2020. For the natural gas production and import market, Engie controlled 40% of market share, up from 35% in 2020.