The electrification of Europe's car fleet is falling behind due to a lack of affordable electric cars available, according to a new report by the Transport & Environment (T&E) mobility umbrella organisation.

While the percentage of electric cars is still rising (14.6% of all cars sold last year were electric), the rate of growth has slowed. According to T&E, this is because the vehicles are too expensive with car manufacturers focussing on larger, premium cars rather than compact affordability.

"European carmakers are holding back the mass market adoption of EVs by not bringing affordable models to consumers faster and at volume," said Anna Krajinska, vehicle emissions manager at T&E. "The disproportionate focus of manufacturers on large SUVs and premium models means we have too few mass-market cars and too high prices."

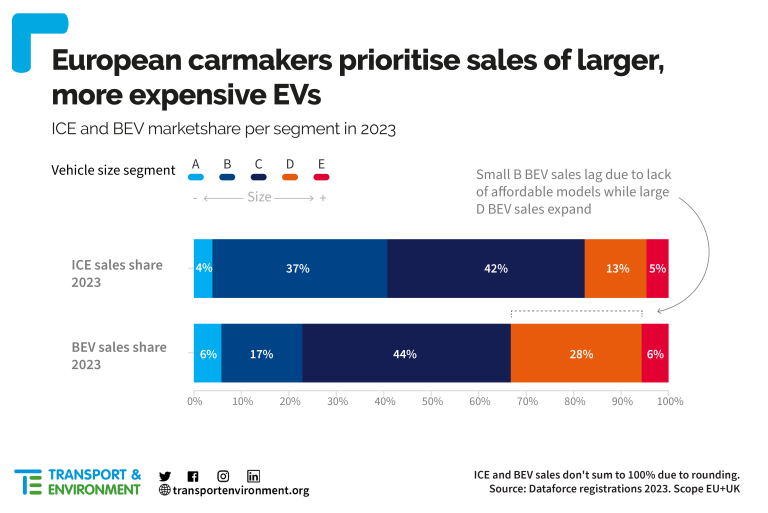

Just 17% of electric cars sold in Europe are compact vehicles in the cheaper B segment (the second smallest category, such as a Citroën C3, Ford Fiesta, Renault Clio or Volkswagen Polo) compared to 37% of new combustion engines, a new analysis found. An electric car in that category costs an average of €34,000 "while many fossil models are available for less than €20,000," said T&E.

Customers looking for a small electric car do not have much choice: this year, only 42,000 electric cars cheaper than €25,000 will enter the European market. The report highlights the "disproportionate focus of manufacturers on large SUVs and premium models [which] means we have too few mass-market cars."

This is also reflected in the sales figures: more than one in combustion engine cars sold belongs to the compact B-segment. For electric cars, this is only one in six.

By prioritising sales of larger, more expensive electric cars, carmakers are slowing EV adoption, T&E argues. In Europe, 28% of electric sales are in the large car D segment, compared to just 13% of new combustion cars.

Strikingly, the average price of a battery electric car in Europe has increased by 39% (+€18,000) since 2015, while in China it has fallen by 53%. This, too, is due to European manufacturers’ focus on large cars and SUVs, which carry a price premium.

Belgium in the lead

However, the Chinese market cannot be compared to the European one "without adding a few caveats," Jochen De Smet, president of the electric mobility federation EV Belgium (and not involved in the study), told VRT. "There is a large degree of state support there, and they can also scale up much more."

Additionally, China has had a technological lead since 2015, when it made a resolute decision that battery vehicles will be the future. In Europe, there was a longer indecision between batteries and hydrogen. Some (mainly German) carmakers still oppose European regulations that favour electric cars.

A model from the Chinese BYD brand, a major player in the EV market that could soon take a dominant role in Europe as well. Credit: Wikimedia Commons

"Company cars are the perfect candidate for electrification. They are heavily subsidised through tax cuts and companies have the financial muscle to invest in EVs," said T&E's Krajinska. "That is why the EU must come forward with a law that covers a large portion of the company car market, by regulating leasing giants and companies with big car fleets."

In Belgium, commercial vehicles account for about 70% of new cars sold. "By the end of this year, half of new Belgian cars will be all-electric," De Smet said, pointing to the rapidly falling emissions from Belgium's car fleet. The same cannot be said for the rest of Europe, where the share of electric in company cars is lower than in private cars.

Related News

- Brussels residents still reluctant to ditch cars for sustainable transport

- Flemish Government agrees on electric vehicle bonus

- Non-electric company cars spared from higher tax but bicycle benefits increased

Overall, the EU market share of battery electric cars grew by 2.5 percentage points to 14.6% in 2023. This could already be at 22% if the corporate car segment – which accounts for most new car sales – were leading on electrification, the T&E analysis also found. Currently, with an electric uptake of 14%, the corporate sector is lagging behind the private market (15%).

Taxation also plays an important role in incentivising electric car uptake but in countries such as Germany, carmakers have opposed the reform of company car taxes that would increase the tax burden on petrol and diesel cars.

Setting binding electrification targets for corporate fleets will also be key to accelerating electrification in Europe. Therefore, T&E is calling on the EU to set targets for fleets to be 100% electric by 2030 at the very latest. The EU Commission has opened a public consultation on greening company cars.