2023 saw a sharp turn in the growth of the plastics recycling industry. Since the beginning of the year, prices of recycled plastics have decreased by up to 50%, while cheap imports of materials from outside of the EU have significantly increased.

If urgent measures are not taken to alleviate the pressure on the European recyclers, repercussions would be significant – leading to the shutdown of recycling plants across the EU and having knock-on effects on jobs, the overall economy, and most importantly the environment. Not only that, it would also call into question the realization of the targets set forth by the EU Green Deal, as Europe works toward carbon neutrality.

There is, nevertheless, an answer to this challenge with the introduction of certification mechanisms and enforcement measures to complement the legislative requirements.

Market state of play before the 2023 downturn

Despite the slow-down of activities caused by the COVID-19 pandemic, paired with the rise of energy costs, plastics recyclers remained resilient in the recent years. This was largely due to strong legislative support which brought an increased certainty for the transition toward a circular economy for plastics.

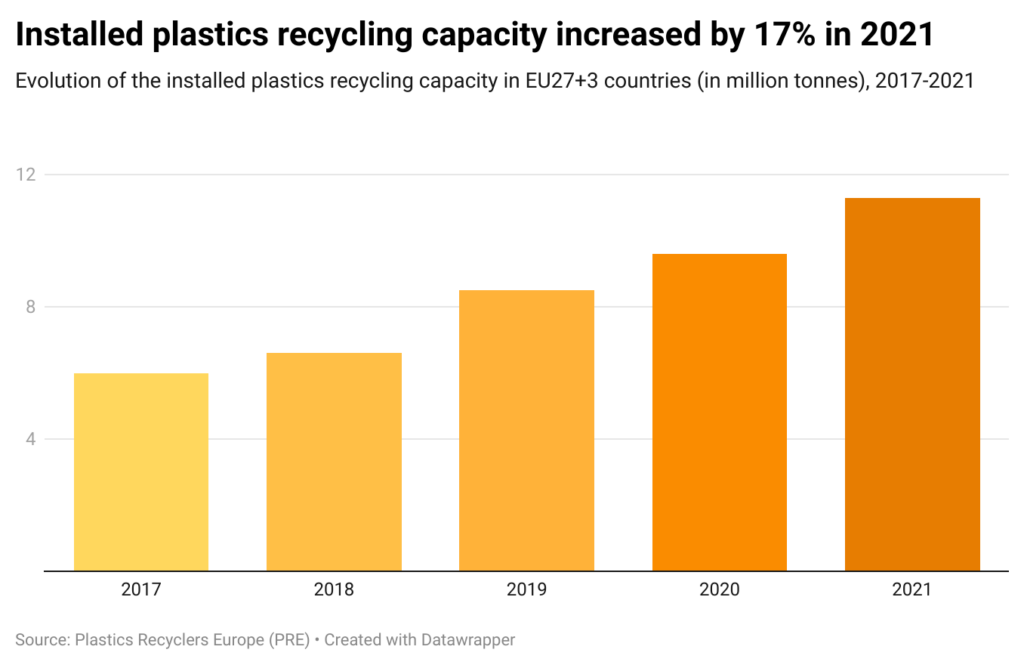

In 2021, the total installed plastics recycling capacity in EU27+3 reached 11.3 million tonnes – increasing by as much as 33% since 2019. More than 7 million tonnes of recycled plastic material were fed back to the market, resulting in a decrease in CO2 emissions equivalent to all passenger cars in Belgium in the same year.

The industry generated € 8.7 billion in turnover and employed more than 30,000 people across Europe.

How did the market downturn come about?

The EU has worked vigorously on setting a coherent legal framework to guide the transition toward a circular future for plastics. This includes targets on overall recycling rates, but also more specific ones like the mandatory use of recycled plastics in beverage bottles included in the Single Use Plastics Directive. The latter calls for 25% recycled content by 2025.

At first, this measure has prompted increasing demand for recycled plastics on the European market, leading to increasing prices. However, it led to an unforeseen side effect – packaging producers have turned to cheaper alternatives in the form of loosely monitored imports from outside of Europe.

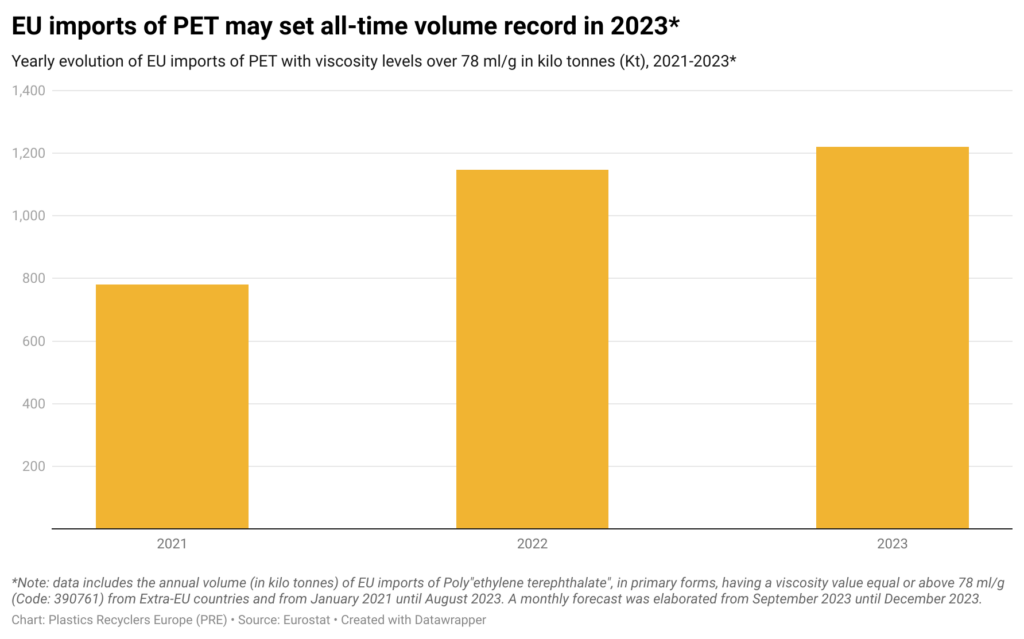

The declining market situation applies to all recycled polymers and is best represented in the polyethylene terephthalate (PET) industry. Due to the lack of a level-playing field, PET imports to the EU have increased by 20% from June 2022 to June 2023* resulting in low demand for EU recycled PET.

Given the low demand and increasing imports, European recyclers are faced with a surplus of stock. Consequently, these disruptive market dynamics have led to decreases in the production of recyclates – for the PET market the decline was estimated at 10%.

To overcome this downturn, it is imperative to ensure the same rules are applied to all players on the market. Restricting imports is not the answer to the problem, but rather ensuring the same level of traceability for materials that are imported, as well as applying the same legislative requirements as for those that adhere to European recyclers. Only by creating a level playing field, we can ensure that the incentives for future investments and technological innovation persist.

What must be done to ensure a circular plastic future?

Legislation has proved itself as one of the most effective instruments in setting the course for an accelerated transition toward circularity. However, pairing legislation with enforcement measures is a must to ensure they are implemented effectively and that loopholes are limited.

Nowadays, the EU recyclers are subject to robust legislation and safety requirements, which on the contrary cannot always be verified for the imported material – leading to the lack of a level playing field. This is why the harmonisation of the rules would help companies move away from business models that favour purely economic benefits at the expense of environmental performance.

When it comes to increasing traceability of imported materials, independent third-party certifications will help solve the current issue on the market. Such schemes must be based on verifying the origin of waste – providing a proof of where the plastic waste is sourced from, how it is recycled and to whom it is supplied.

In parallel, certifications would help to avoid unverified declarations. Nowadays, companies are free to make claims on the use of recycled plastics without harmonised methods of calculation and verification. This means that there is no way for consumers to know whether the percentage they see on the package is real or not. However, when certified via a reliable audit scheme, the consumer can be sure of what they are buying as sufficient information will be provided on the environmental performance of the product.

Such transparent information instils trust among consumers enabling them to make environmentally conscious purchasing decisions. Therefore, when it comes to consumer empowerment more must be done to ensure the clarity and reliability of product claims to avoid greenwashing.

To conclude, the groundwork has been laid out by the plastics recycling industry through the vast investments and innovation over the last decades, setting the course for the systemic change towards a sustainable use of resources and a carbon-neutral Europe. The commitment of the European recyclers is clear – while much work remains ahead, the past successes are the foundation upon which the circular plastics future can be built. To achieve its full potential, however, more coherent implementation of legislation is a must for the plastics recycling industry to retain its competitiveness in light of market challenges such as the ones it is currently facing.

* In comparison to the same period in 2022; this includes imports of both virgin and recycled PET (Eurostat).

Promoted by Plastics Recyclers Europe