Belgium's inflation rate fell to 0.7% last month, down from 2.4% in August: the second lowest rate in the eurozone and well below the currency union's average of 4.3%.

The data, which was published by Belgium's official statistics agency Statbel on Monday, means that only Belgium and the Netherlands posted rates below the European Central Bank's (ECB) 2% target in September.

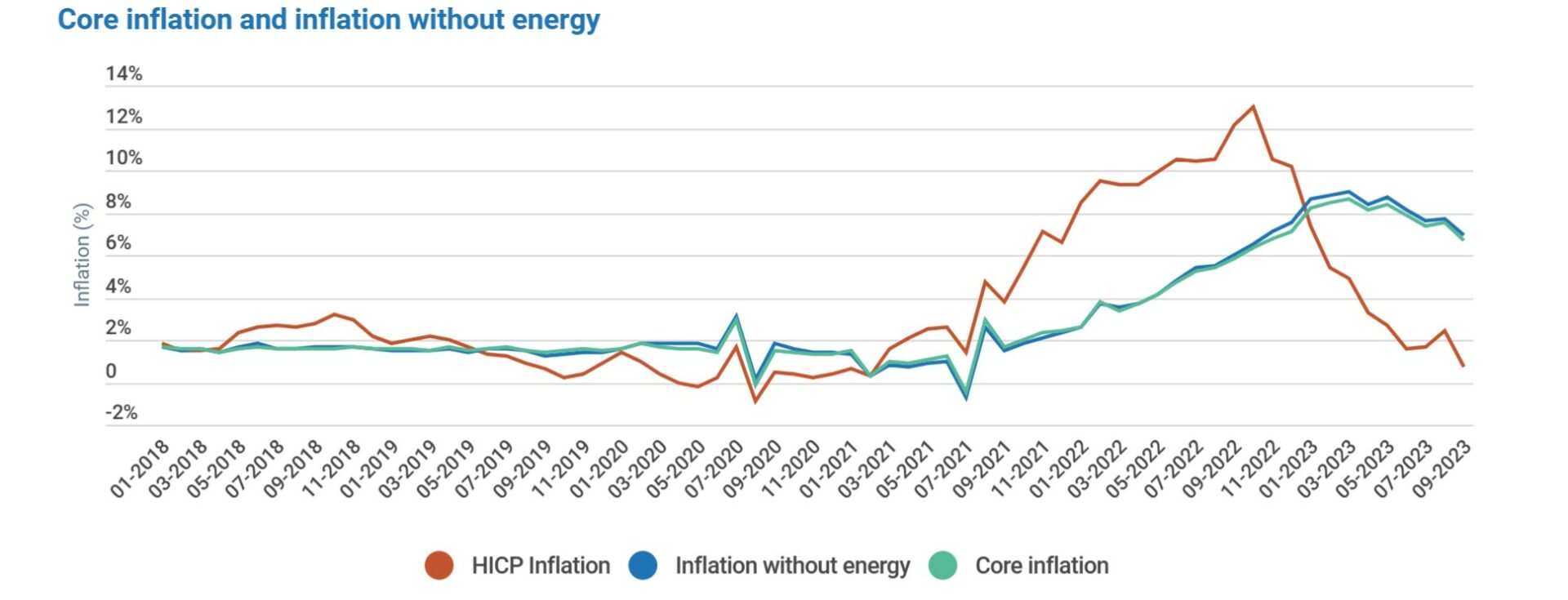

Belgium's core inflation rate, which strips out energy and volatile food prices, also underwent a marked decrease, from 7.5% to 6.7%.

Credit: Statbel

Statbel reported that lower energy prices were the principal reason for the headline rate's decline. Natural gas is currently 73% cheaper compared to this time last year, while electricity is 43.9% less expensive.

Conversely, food continued to exert significant upward pressure on prices. Despite falling over the past month, inflation for both processed and unprocessed food remains extremely elevated (at 11.2% and 9.9% respectively). Overall, food and non-alcoholic beverages contributed 2.0 percentage points to the headline rate.

Core inflation: Still stubbornly high

Headline inflation in Belgium has now fallen fairly steadily since peaking at 13% in October last year. Core inflation has also steadily declined since reaching a record high of 8.6% in March. Core inflation was negative as recently as June 2021.

Belgium is not the only eurozone country where core inflation remains stubbornly high. In September, the eurozone's average core inflation rate fell to 4.5%, down from 5.3% in August: a sizeable but hardly enormous decline from its March peak of 5.7%.

Core inflation has remained elevated in spite of repeated interest rate hikes by the ECB over the past year. At its last meeting in September, the bank increased its benchmark deposit facility rate by 25 basis points (0.25 percentage points) to a record high of 4.0%.

Related News

- 'We are getting closer': ECB hikes interest rates to record high

- Soaring corporate profits responsible for Europe's inflation crisis, IMF study finds

In a speech delivered to International Monetary Fund officials in Marrakech last week, ECB President Christine Lagarde hinted that core inflation's persistence could mean that the bank will hike interest rates for the eleventh consecutive occasion at its next meeting on 26 October.

"Core inflation remains at elevated levels, reflecting the fact that the fading impact of the past surge in input costs is being counterbalanced by rising labour costs," Lagarde said.

She added: "It's not a question of being hawkish or dovish, but it requires us at this point in time to be patient, as supply shocks reverse and new shocks arrive, and be attentive to ensure that inflation expectations remain anchored when inflation is still too high."