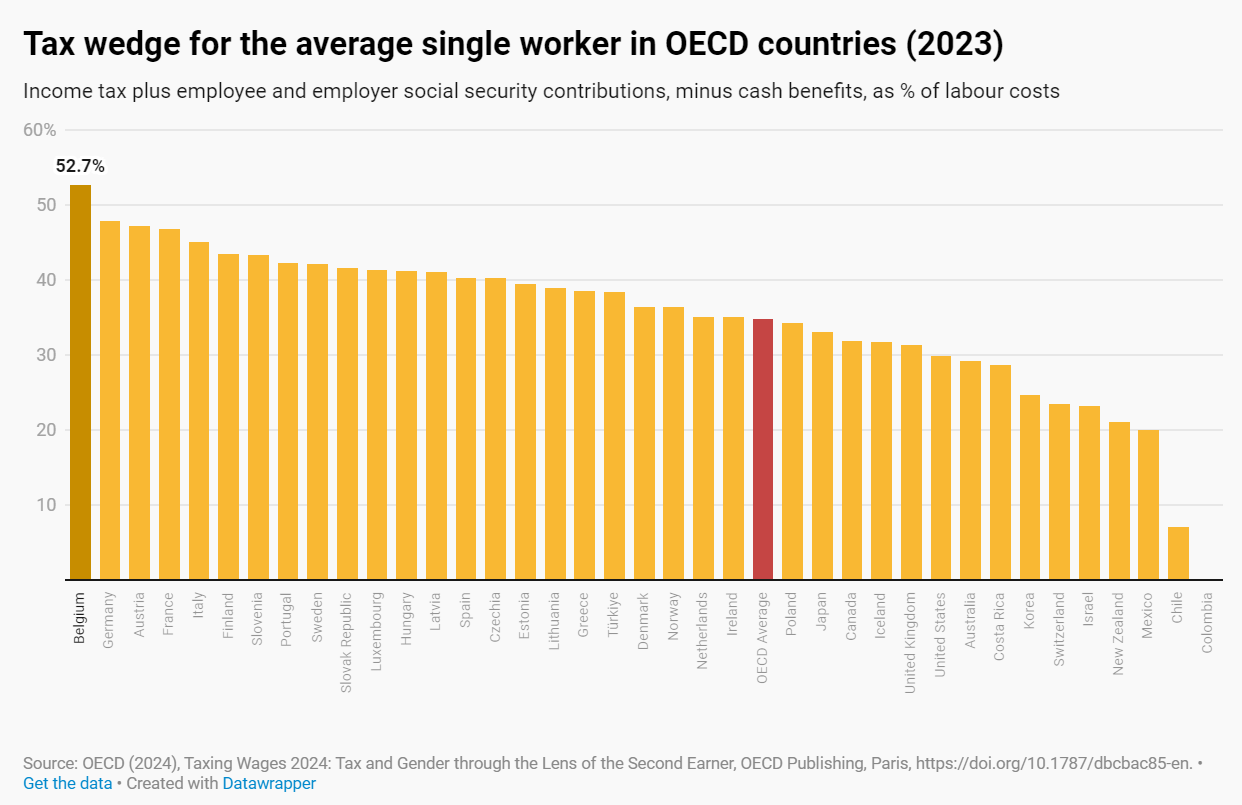

Nowhere is the tax burden on employed single people as high as in Belgium, the latest edition of Taxing Wages, published by the OECD showed. The figure has decreased since 2000 but is higher than in 2019, despite political promises to lower it.

Belgium is the only country of the 38 countries in the OECD (Organisation for Economic Cooperation and Development) where more than 50% of a gross salary is skimmed off.

For single, childless people, the tax wedge in Belgium is 52.7%. This means for every €100 a boss pays a single person on an average wage as part of the labour costs, only €47.3 goes to the worker as net wages, while €52.7 goes to the state treasury. With this figure, Belgium is the worst performer.

"No other OECD country comes close to our tax burden," UGent labour economist Stijn Baert said. The country performs much worse than the OECD average (34.8% in 2023). A five percentage point gap exists between Belgium and Germany, which ranked in second place with 47.9%.

"By comparison, the Netherlands sits at a tax wedge of 35.1%," Baert noted. "So for our neighbours, about €65 of every €100 of wage cost for a single person goes towards a worker's net income, almost €20 more than in our case."

Unfilled political promises

The tax wedge for the average single worker in Belgium did decrease by 0.3 percentage points from 53% in 2022 to 52.7% in 2023 (presumably due to indexation of tax brackets), and by 4.4 percentage points from 57.1% to 52.7% since 2000.

However, it is higher than in 2019, when €52.3 went to the treasury," despite all the promises to make work pay that were made during the elections that year," Baert stressed.

"Finance Minister Vincent Van Peteghem's plan aimed to bring the tax wedge below 50%." While that still would have made Belgium the worst pupil in the class, it would not have widened the gap with the country in second place.

Meanwhile, working has become more interesting in Belgium's neighbouring countries. The Dutch tax wedge fell from 36.9% to 35.1%, while in Germany, it fell from 49.3% in 2019 to 47.9%. "So the gap with neighbouring countries in skimmed wages only widened."

Singles worst off

The continued social discrimination in Belgium against single, childless people was once again highlighted in the study. While €52.7 of single people's wages go to the state treasury, while for a couple with two children where one partner receives an average wage, just €37.3 of every €100 paid by the employer goes to the treasury. This is due to child-related benefits and tax provisions for people with children.

With this figure (37.3%), Belgium had the fifth-highest tax wedge in the OECD for an average married worker with two children in 2023. Only Finland, France, Sweden and Turkey do worse. The OECD average is 25.7%.

When comparing the difference between the €52.70 skimmed off the €100 paid to a single person to what a single-earner family with two earns, only Slovakia, Luxembourg, Poland and the Czech Republic perform worse highlighting Belgium's discriminating tax treatment.

If both parents of two children work (one at the average wage, the other at two-thirds of the average wage), €45.1 for every €100 paid by a boss goes to the treasury. "Again: no OECD country does worse," Baert stressed.

Related News

Those earning more than the average wage are even worse off. A single person working at a high wage (167% of the average wage) loses €58.9 of every €100 paid by the employer.

Baert explained that this is nothing new as Belgium has long been at the top of the tax burden list. He noted that these costs do indirectly benefit the worker, for example, through pensions. However, he argued that, while countries like Sweden and Denmark also have quite high taxes, they manage to offer better services in terms of health care, higher pensions and free child care, among others.