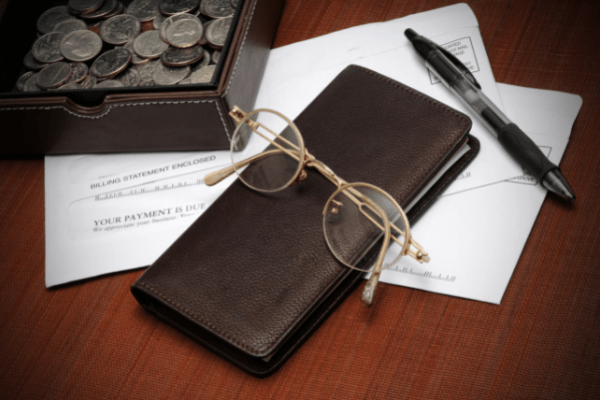

Aside from the pandemic's enormous impact on public health, the impression it has made on the personal finance of Belgians has been highlighted by new figures from the national institute of statistics Statbel: in 2020, 4,622,000 Belgians were unable to save during a typical month.

This equates to almost 40% of Belgians, with the regional disparity being particularly striking: in Flanders 32% were unable to save compared to much worse figures in Brussels (50%) and Wallonia (54%).

Of the 19% of Belgians considered at risk of poverty or social exclusion, 22% were able to save whilst 61% could only just make ends meet. 11% had to use their savings to get by whilst 6% found themselves with no option but to borrow to get by.

Related News

- Six out of ten Belgian entrepreneurs are worried about their cash flow

- Young people can afford to buy houses, National Bank of Belgium finds

- CdH propose €100 refund in response to rising gas prices

Of particular concern, the results show that 3.4% of Belgians went into arrears on payments other than their rent or mortgage in the past 12 months. Simply put, this means that a sizeable minority of Belgians were unable to pay their bills for healthcare, education, telephone or wifi, for example. Most affected are the unemployed (11.7%), single-parent families (9%), renters (8.6%), and those less educated (5%).

One in five Belgians currently have a loan (not including mortgages), and 4.2% have two or more loans. Again, the regional divides are clear, with fewer loans taken out by individuals in Flanders (18.3%) compared to Brussels (31.7%) and Wallonia (37.7%). Additional loans are most commonly used to pay for cars.

The Brussels Times