After a spike during the first two years of the pandemic, the property market is further cooling as mortgage rates rise rapidly, but the downturn is limited compared to other countries.

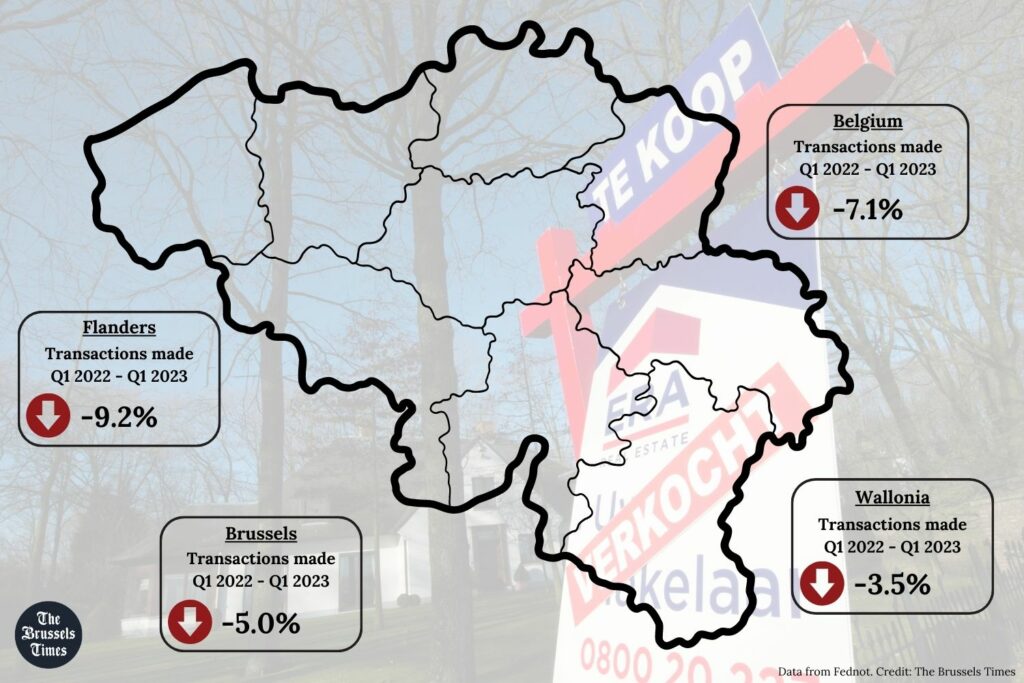

In the first three months of this year, the Belgian property market was markedly more quiet than usual, with the number of transactions dropping 7%, the Fednot's Real Estate Barometer showed.

"Nationally, the number of transactions is 7.3% higher than in the first quarter of 2019," said the spokesperson of the Federation of Notaries (Fednot), Bart Van Opstal.

The drop was more pronounced in Flanders – here, 9.2% fewer transactions were completed compared to the first quarter of 2022, compared to a 5% drop in Brussels and 3.5% in Wallonia. This is largely due to the reform of registration duties in Flanders which saw a remarkable rise in transactions in the first two months of 2022.

Especially in January and February, activity was slow, down by 10.5% and 10.4%, respectively. In March, the decline remained limited, at 1%. "There was about the same number of transactions as in March 2022. Whether this is a temporary flare-up or not will have to be seen in the coming months," Van Opstal said.

But overall, the number of transactions is still higher than before the pandemic. "The exceptional rush during the Covid-19 years is behind us, though. The market is more balanced now. Buyers have a bit more room to negotiate and no longer have to make headlong decisions on whether or not to buy."

Stabilising prices

Prices also seem to be stabilising, with the average price of a house and flat rising by 1.1% and 1.5% respectively in Belgium – much lower than inflation, which when accounted for means the real value of the average home fell.

A house now costs €323,031 on average – which accounting for inflation marks a price decrease of 1.1%. Brussels continues to be by far the most expensive region, with an average house here costing €578,753. For an apartment, the average price nationwide is now €264,139 (though in Brussels the average is €281,918).

The driving factor behind the housing market decline is the increased mortgage rates, which means buyers can borrow less. This has seen the share of buyers aged 30 or younger fall compared to 2022 when younger people rushed to the market to get ahead of rising interest rates. Where in 2022 they accounted for 30.1% of buyers, their share was now 27.6%. The average age of a buyer in the first quarter of 2023 was 40.

Related News

- Buying a house in Brussels to become more fiscally attractive

- Construction sector's rising costs to be borne by customers in 2023

Across Europe, high-interest rates are resulting in house prices falling across the continent for the first time since 2015, when the European economy had recovered from the euro crisis.

While the Belgian market is responding "calmly and stably", property prices in other countries dropped more dramatically: in the Netherlands they fell by 8.2% in the first quarter compared to the same period a year earlier.

This is largely because incomes in Belgium have been better protected against inflation thanks to automatic indexation. Additionally, the overvaluation of the Belgian property market was limited compared to other countries, meaning the impact is less if the market tilts.