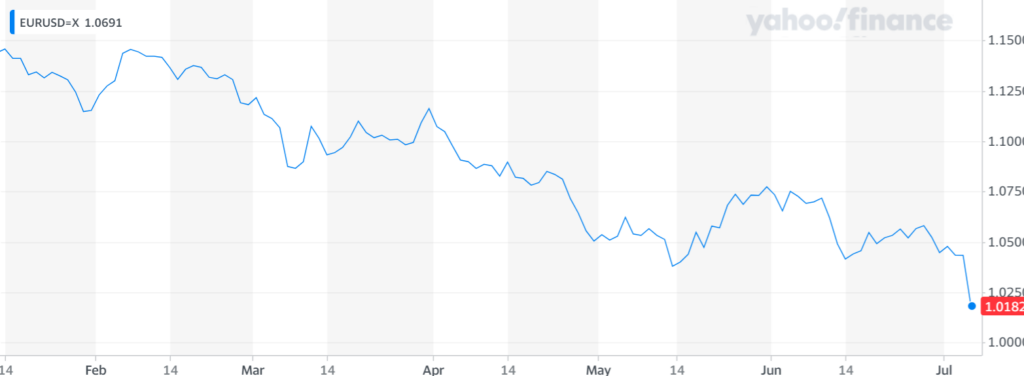

The Euro plunged by more than 1.3% on 5 July, hitting lows unseen since December 2002. Rapidly escalating energy prices, which are fuelling inflationary pressures, have now triggered concerns that a global recession is just around the corner.

The Euro had already lost around 10% of its value since the start of the year, driven by the war in Ukraine and attempts by the Federal Reserve to control spiralling inflation. Undoubtedly, the greatest contribution to the drop in Europe’s single currency, as well as inflation, is rising energy prices.

Credit: Yahoo Finance

On the Dutch TTF futures market, natural gas prices have risen to their highest level in around four months, aggravated by recent strikes by gas workers in Norway and Russia’s throttling of supply. In the space of a year, the price of gas has risen by around 140%.

Eurozone under severe stress

Increased energy prices, as well as the increase in an array of input costs, are already having a significant impact on the EU economy. Europe’s purchasing manager’s index (PMI) continues to fall, suggesting a slowdown in the eurozone. Money markets also continue to deteriorate, dropping massively in the space of three weeks.

Unlike the FED, which is fighting to control inflation, the European Central Bank (ECB) appears to have entirely failed in this mission. The ECB aims to achieve 2% inflation over the medium term. Yet with no end to high inflation in sight and the ECB unwilling to take more drastic measures, it seems that this target has now been abandoned.

Related News

- Understanding Belgium's rampant inflation and what's in store

- Not stonks? European stock market drops to lowest since 2008

All this considered, it is increasingly likely that the Euro will reach parity with the dollar by the end of the year. Bloomberg estimates that there is now a 60% chance of this, compared to just 46% at the start of the week.

This massive drop in the value of the Euro could have major implications for the European economy. According to Bloomberg, traders are already warning that the Euro risks becoming “unbuyable” if it reaches parity with the dollar. In recent months, shorting the Euro has been extremely popular among currency traders.

“It’s all about Russia,” Kaspar Hense, senior portfolio manager at BlueBay Asset Management told Bloomberg. “If we see oil rationing in Europe because of a cut in Russian supplies, we will see a significant recession in Europe. It could be a very long winter.”