Bankruptcies across the EU have soared to record levels, inflicting further misery upon Europeans at a time when soaring inflation and high energy costs have already left many of the continent's citizens on the brink of financial despair.

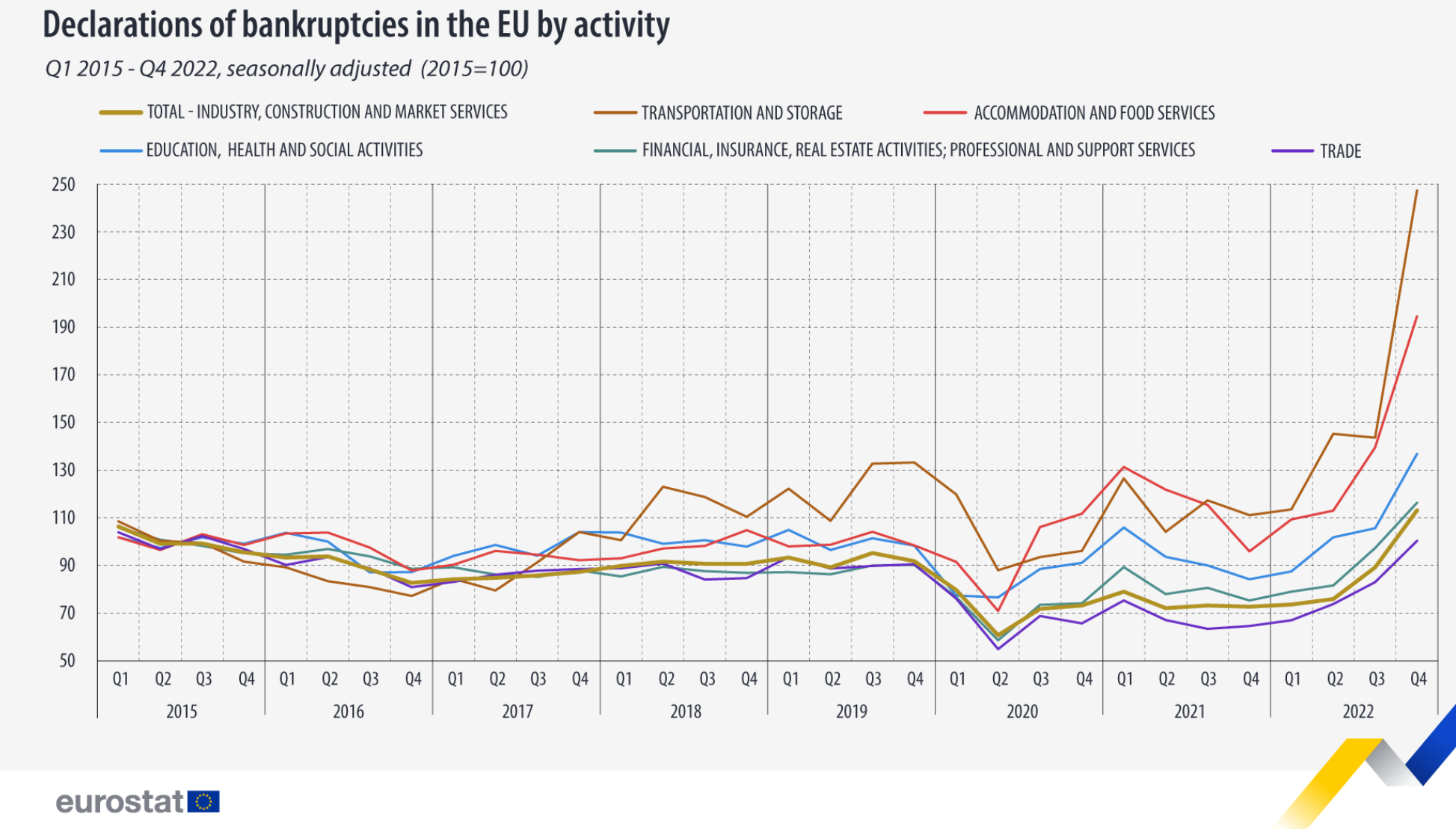

According to a new report published on Friday by Eurostat, the EU's official statistics office, bankruptcies in the final quarter of 2022 rose 26.8% relative to the previous quarter. The latest data implies that bankruptcies within the bloc increased in all four quarters of 2022, and are now at their highest levels since Eurostat began collecting insolvency records in 2015.

All economic sectors registered a rise in bankruptcies: the largest increases were noted in the transportation and storage sector (72.2%), followed by accommodation and food services (+39.4%), and education, health, and social activities (+29.5%).

The contrast with the pre-pandemic bankruptcy rate was particularly enormous. In particular, compared to the fourth quarter of 2019 — the last quarter before the Covid-19 pandemic restrictions came into force — bankruptcies in the accommodation and food services sector rose by a whopping 97.7%, while the transportation and storage industry registered a similarly significant 85.7% increase.

Who, or what, is to blame?

Although Eurostat itself did not suggest any reasons for the surge in bankruptcies, an examination of the available data strongly suggests that it was precipitated by Russia's full-scale invasion of Ukraine in February last year. This, in turn, triggered a raft of EU sanctions on Russian industry and energy supplies, which led Moscow to retaliate by restricting its energy supply to Europe, thereby causing energy prices to soar.

The increase in bankruptcies has been particularly noticeable in Belgium. According to market analysis firm GraydonCreditsafe, bankruptcies across Belgium rose from 1 in 217 businesses in 2021 to 1 in 151 last year — a rate increase of 44%. The bankruptcy rate was particularly elevated in Brussels, where 1 in 101 declared themselves insolvent in 2022. In Flanders, the bankruptcy rate was 1 in 158, while in Wallonia it was 1 in 176.

Related News

- 'Empty spaces in city centres': Bankruptcies in Belgium set to increase in 2023

- New study paints stark picture of Belgium's growing economic despair

GraydonCreditsafe's analysis was corroborated by the results of a recent poll, which found that three-quarters of Belgian independent retailers fear bankruptcies over the coming months. Shopkeepers attributed their financial difficulties to multiple factors, including soaring energy bills, government-mandated wage indexations, and general inflation.

The survey also found that the vast majority of shops had resorted to cost-saving measures in order to remain solvent, including reducing their heating and switching off their outdoor lighting.